Touchscreens aren't only on our smartphones and tablets. There are touchscreens all around us: at the shopping centre, at the bank and at the airport.

When you visit your local coffee shop, your order may be taken by someone using a touchscreen device. If you buy fast food at some chains, you can enter your order on a touchscreen. When you shop for groceries, you can go to the self-serve checkout. That's dominated by a touchscreen.

The touchscreens intended for public use are usually large, with big, clear text. And they are usually quite clear in guiding you as you use them.

Automatic Teller Machines (ATMs) are now the most common way for people to do their cash banking, whether its withdrawing money, checking bank balances or paying in cheques.

There are many different models of ATM. All of them have a big display screen and many of them have touchscreens. Those that don't, usually have a column of buttons to the left and right of the screen. Labels appear next to the buttons on the screen, and they usually change from screen to screen.

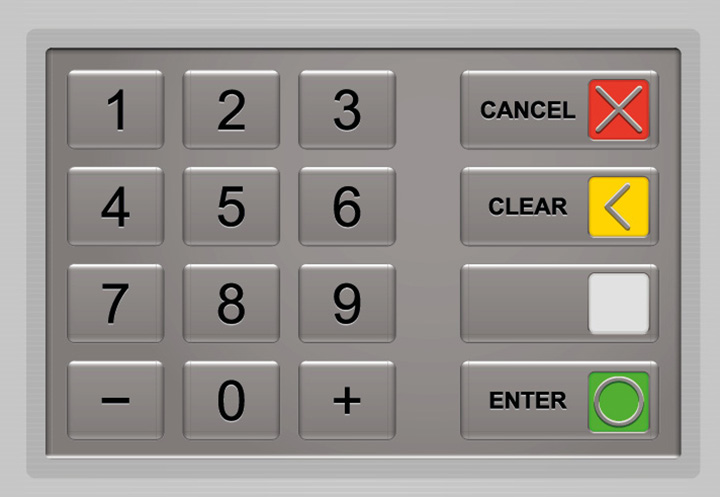

All ATMs, even those with touchscreens, also have a set of physical buttons, usually just below the screen. These contain number keys along with keys labelled Cancel, Clear and Enter or OK. When you enter your PIN, it's always on this mechanical keypad.

If you're not familiar with using an ATM, don't worry. It's quite easy. The main thing is not to rush. Just read the instructions from the screen.

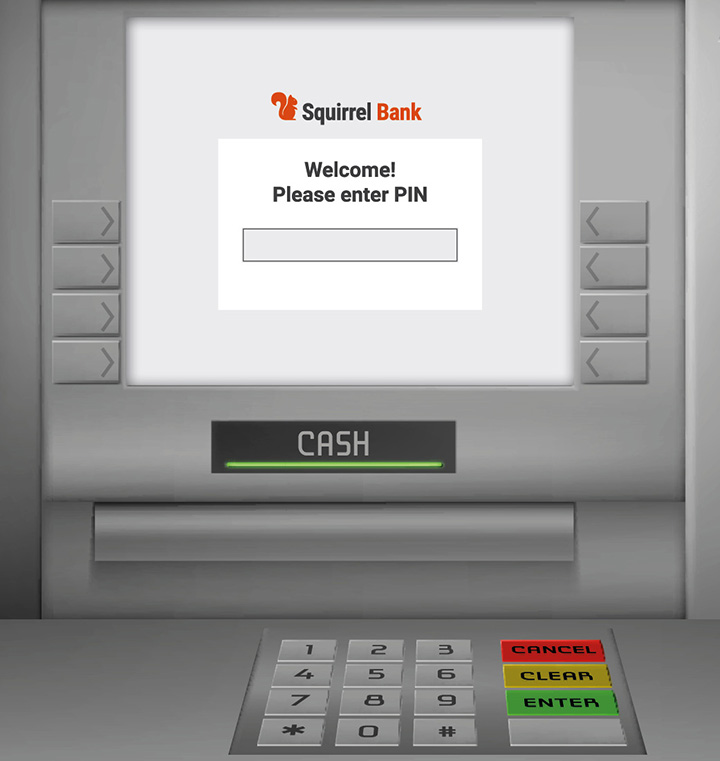

In order to do things with your bank account using an ATM, whether a touchscreen model or otherwise, you first have to identify yourself to it by logging on. To do that you need the plastic card (usually a debit card) issued by your bank and your Personal Identification Number, or PIN.

But before we log on, let's think about two things: your security, and the possible cost of using an ATM.

You should only use an ATM where and when it is safe to do so. Good places are in shopping centres during normal shopping hours when there are plenty of people around. Another good place is in the foyer of your bank's branch if it has ATMs there.

The ATM will often recommend that you cover up your hand as you enter your PIN. That's to stop other people from seeing the PIN that you enter. There have also been instances where small cameras have been placed on or near ATMs to record PINs. So, covering the keypad with your hand when you enter your PIN is a good idea.

Your own bank's ATMs are free for you to use. Making a withdrawal from some other financial institution's ATMs, or from ATMs owned by separate businesses, can attract a fee. Often the fee is around $2.50. These ATMs will not proceed to issuing your cash until you confirm that you're prepared to pay the fee, so you should not be charged accidentally.

Most of the larger banks no longer charge fees, so if your own bank's ATM is not handy, you can try one of those.

Step 1. Look for the slot where you will insert your card. It is often brightly lit to make it easy to find. It will usually have a picture of a banking card under it so that you can see which way around to insert yours.

Step 2. Insert the card firmly but gently. Many ATMs will pull the card in after the first little bit. If you change your mind, you can press Cancel on the keypad and your card will be ejected.

Step 3. After a pause while the ATM reads your card, it will invite you to enter your PIN. Enter the PIN using the physical buttons on the keypad and then press the Enter or OK key. Don't forget to cover your hand.

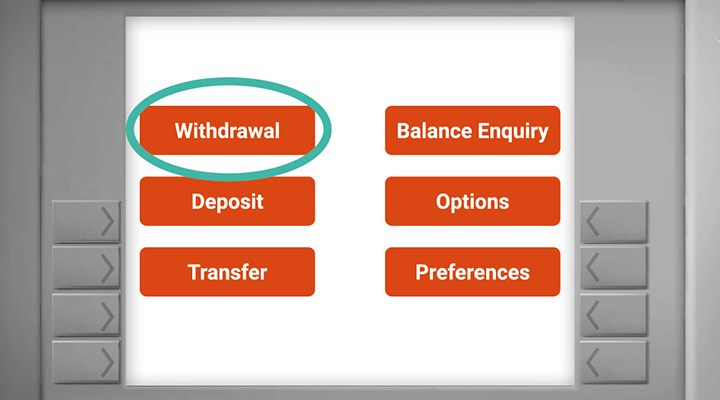

Step 4. After the ATM checks your PIN, you will see a list of things you can do on the ATM. Generally, these will include withdrawing money, checking your balance and transferring money between accounts. Sometimes other options, such as making a deposit, are available.

If the ATM has physical buttons beside the screen, you will make selections using those, but an increasing number of ATMs have touchscreens. To select something, you tap an option.

Bank ATM touchscreens tend to be less sensitive than your phone's, and less versatile. You will be able to tap an option, but you won't be able to scroll or swipe on an ATM touchscreen. And because they are less sensitive you will probably need to tap more firmly.

Often, ATM touchscreens are a little slow to respond. When you tap an option on the screen and nothing happens, wait a second or two before you try again.

One main use of ATMs is to draw cash from your account. This is easy. Just remember to take it slowly, read the screen and tap the buttons firmly and deliberately.

Step 1. Log on to an ATM as described above.

Step 2. Tap on the Withdrawal button (it might be called something slightly different).

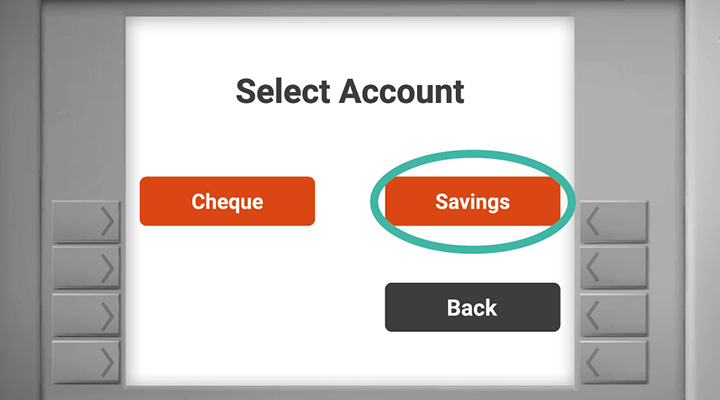

Step 3. Tap on the Account type you want to withdraw from. Which accounts are offered on the screen will depend on your bank and the way your accounts are organised. Often the options will be Cheque and Savings. Cheque does not necessarily mean that you have a chequing account. Sometimes second accounts are called that for historical reasons.

Step 4. If you are not sure which account you wish to withdraw from, you can tap the Back button on the screen and then check the balances of the different accounts to help you decide.

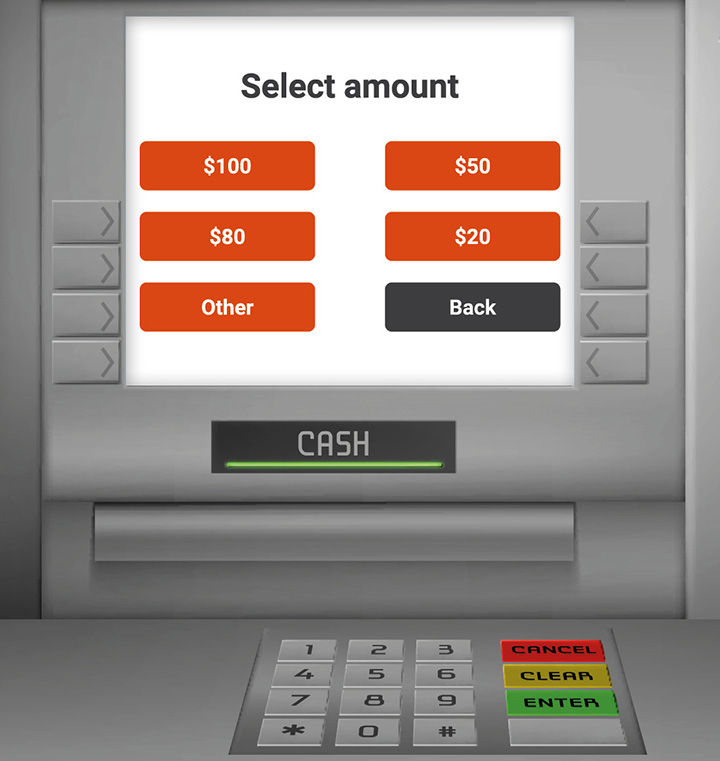

Step 5. The next step is to choose how much money to withdraw. Generally, the ATM will offer you a selection of fixed amounts ($20, $50, $100 and so on), plus an option to enter in an amount using the ATM's physical keypad.

Step 6.Tap on the amount, or on the option to enter a different amount. Note: the ATM only has a couple of different kinds of banknotes, typically $20 and $50 notes, so you can only enter amounts which can be delivered in those notes. The ATM will let you know if you put in an amount it can't handle. In addition, the ATM will have an upper limit as to how much cash it will provide.

Step 7. Tap the Enter button, or whatever button is provided to confirm the transaction. At this point, some ATMs will ask whether you want a printed receipt. Some include that question earlier in the process.

Step 8. After a while, the ATM will pop your card back out and issue the cash and a receipt if you asked for it. Don't forget to take the cash and card.

Every other action you perform on an ATM is similar. You log on with your card and PIN, you select the task you want to perform, followed by the account and, if necessary, indicate the amount of money involved.

Whether you're taking money out of your bank, buying groceries, ordering fast food or finding your way around a shopping centre, you will frequently be using a touchscreen. Take your time and carefully follow the prompts on the screen.

An ATM touchscreen is easy to use, with many offering assistive technology and design features to improve accessibility. These include multi-lingual menus and instructions, Braille keypads, text-to-audio voice assistance, hearing loops for connecting hearing aids, high contrast screens and wheelchair access. You can contact your bank for more information about accessible ATMs near you.

As you become more familiar with your local ATM, you will find that you're completing common transactions more quickly and confidently.