Tips for safer online banking

Tips for safer online banking

What's coming up?

So far in this course, you have learned that online banking is safe and that your finances are secure so long as you follow the rules.

In this activity, you will learn some more advanced tips to make sure that you stay even safer in your online banking.

Start activityDo not use the same password for everything

We are all creatures of habit, and it's convenient to use one universal password for everything, but this will reduce the safety of your account and hard-earned money.

If someone learns or guesses your universal password, they can use it to access all your online accounts, from unimportant things right up to your bank accounts.

eSafety tip

Choose an online banking password that's easy for you to remember but hard for others to guess. It should not be a recognisable word, and it should have a minimum of eight characters, use a mix of numbers, upper and lowercase letters and symbols.

You can find out more in our Managing passwords course.

Don't save passwords to your browser

Your browser may offer to save your online banking password so that it fills it in automatically the next time you visit the bank's website. This may sound convenient, but it reduces your money's security, so don't be tempted to save your banking password to your computer's web browser.

Take care of your credit card

Be careful when using your credit card online. Only use it to buy from online stores you trust. Carefully check the web address at the top of the page to make sure it matches the store name, and look for a padlock and https at the beginning of the web address to make sure the connection to the site is encrypted.

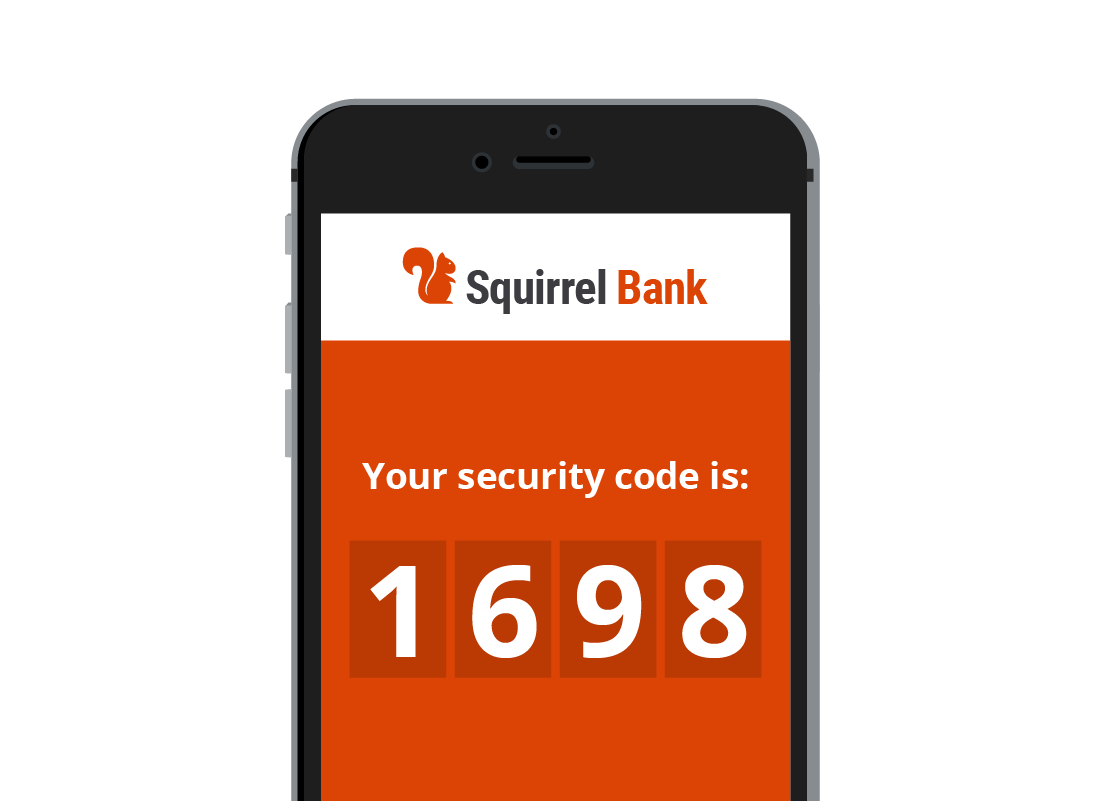

Your mobile phone password

Your bank will sometimes text you secret codes to confirm that you have authorised a transaction. This is sometimes called Two Factor Authentication or Two Step Authentication. It is an additional level of safety so the bank knows it's you trying to access your money. This means your phone is like a key to your account.

Make sure the password or passcode you use to unlock your phone is strong and private. That way, even if someone else has your phone, they won't be able to unlock it and authorise false purchases.

eSafety tip

You can secure your phone with a strong password or passcode, or, if it has them, use its fingerprint scanning or facial recognition features to help ensure no-one else can access your personal or banking information.

Let's check …

Decide if the following statements are true or false. Click each card once to turn it over and see the answer.

It's safe for me to get my browser to remember my online banking password.

Click to flip

This is false.

Whilst it might be convenient, it's definitely not safe. Never allow your browser to remember your password for online banking.

It's not safe to use public Wi-Fi for internet banking.

Click to flip

This is true.

Public Wi-Fi in shops, hotels, airports and the like is not safe to use for anything online that requires a username and password, and should never be used for online banking.

Well done!

This is the end of the Tips for safer online banking activity. You've learned that there are some extra precautions you can take to ensure you help keep your bank account safe.

Next up, if you have registered and are logged into the Be Connected website, you'll now be able to take a short quiz to finish the course. If you're not registered, you are now at the end of the course.