Preparing for online banking

Preparing for online banking

What's coming up?

In this activity, we will look at what you need to enjoy a safe online banking experience. Once you are set up, you can access the benefits of online banking whenever you need to.

Start activityFrom the top

There are a few things you need for online banking, and we'll look at these separately in this activity. They include:

- a bank account and some personal ID,

- a computer, smartphone or tablet with up-to-date software,

- a secure home internet connection,

- a mobile phone number.

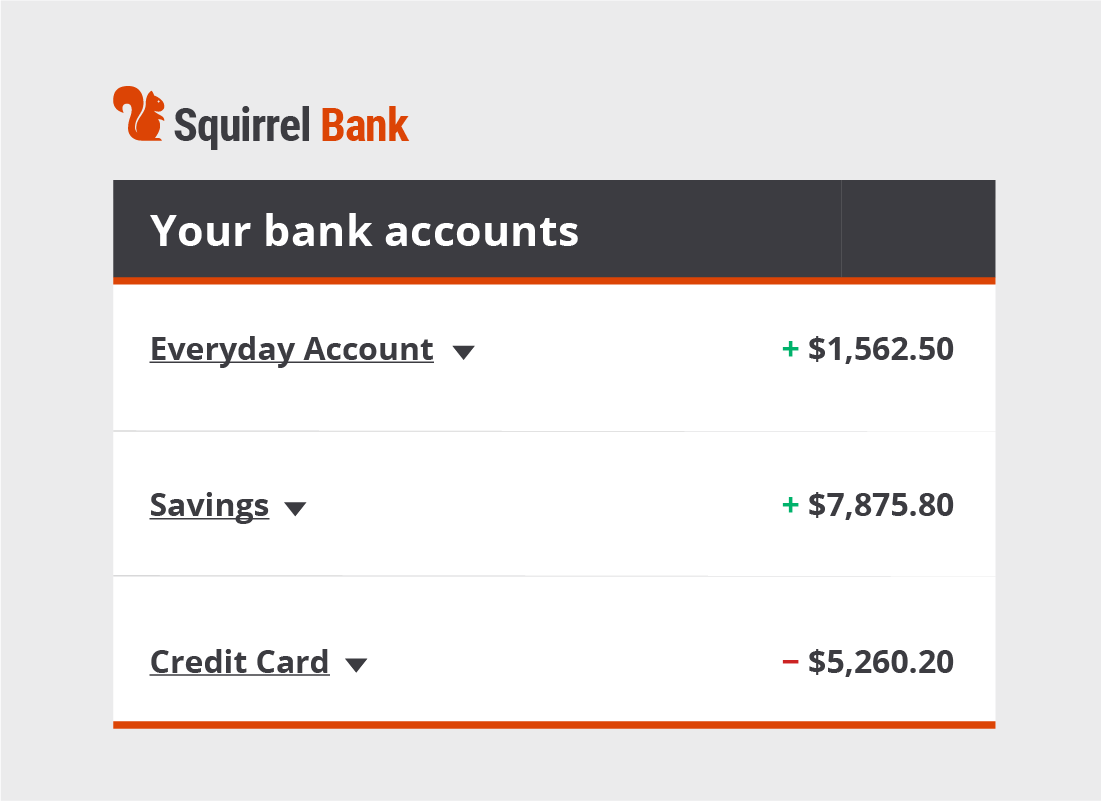

Your bank account

You don't need to worry about changing banks or opening new accounts to get started with online banking. All banks provide internet banking services, and you can use your existing accounts to bank online.

If you haven't banked online before, you can either visit your bank in person to ask them to help you get set up, or you can visit your bank's website and register online. The register option is usually located under the Log on button.

You may need ID

If you want to visit your bank in person so they can help you set up online banking, you will need to prove your identity to the bank. You will need to take documents such as a current driver's licence or passport, and proof of address, such as recent rates or an electricity bill.

If you are registering online for an existing account, ensure that you have a recent bank statement handy so that you can readily find your account number and other details you will need to enter as part of the registration process.

A computer or other device

You can use a desktop or laptop computer, a smartphone or a tablet to bank on the internet. When using a desktop computer or laptop, you bank online using the bank's traditional website. If you use a smartphone or tablet to bank online, however, you will most likely use an app, as it's better designed to cope with small screens. While the website and the app versions may look a bit different, the way they work is very similar.

For the activities in this course, we're using the traditional website version of an online bank account that you would typically access using a desktop computer or laptop. Your own bank's website might look a little different to our examples, but you should still be able to follow along.

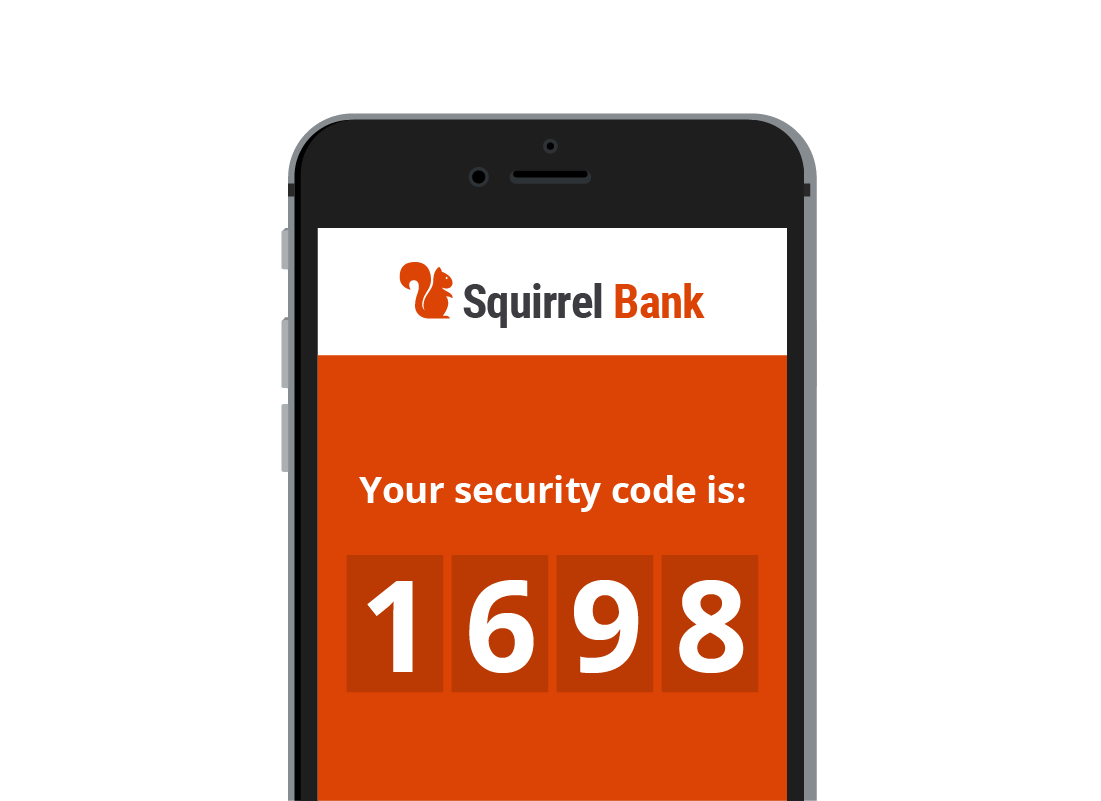

A mobile phone

For security, you will need a mobile phone and number. Your bank will occasionally need to send you a secret code so you can confirm it's you who's accessing your accounts. The code can be sent to your phone as a text, or SMS message. This additional layer of security is sometimes called Two Factor Authentication, or Two Step Authentication.

eSafety tip

If you don't have mobile reception, such as when you travel, you may not be able to receive codes via SMS. Instead, most banks can provide codes via a small gadget called a token, or an app on your phone. Check with your bank about which method it uses, so they can help you set it up before you travel.

For your added protection, banks can block your accounts if they notice any unusual transactions, so remember to notify your bank of any international travel plans in advance.

Internet access

If you are banking online using your bank's website, you'll need a home Wi-Fi connection set up to access the internet. Your home Wi-Fi should be set up securely so that no one can connect to it unless they have the password. If you are not sure about home Wi-Fi, why not find out more in our Wi-Fi and mobile networks courses.

eSafety tip

Even though you access your bank's website just like any other website, the bank uses security protections that ensure no one can intercept, or listen into, your data during an online banking session.

Keep your software up-to-date

Software makers are always making their products more secure by releasing updates and patches from time to time. Keeping your computer's software up-to-date is the best way to take advantage of those improvements. This means accepting the latest updates to your computer's operating system and, for added protection, we recommend installing antivirus software. We have a short course on Using antivirus software? if you want to find out more.

eSafety tip

Using your home Wi-Fi is safest way to bank online, as the connection between your computer and your Wi-Fi router is private and secured by a password. Public Wi-Fi is not safe, as it often doesn't require a password to gain access, and/or the Wi-Fi connection itself is not encrypted. This means scammers can eavesdrop, and perhaps steal your passwords and personal information.

This is not just at shopping centres either, public Wi-Fi at hotels and airports and other public places can also be insecure. To keep your information private, don't use public Wi-Fi for anything that requires you to enter a username or password.

Record your bank's contact details

You can always look up your bank's phone and contact details on the internet, but it's also good to write them down and keep them in a safe place for reference. Keep a copy of your bank's phone number with you when you go travelling too, just in case you need it.

Well done!

This is the end of the Preparing for online banking activity.

Up next, we'll find out how to begin banking online in the Using a banking website activity.