What is mobile banking?

What is mobile banking?

What's coming up

In this activity, you will learn what mobile banking is, and how it can make many common banking tasks easier and more convenient.

Start activityWhat is mobile banking?

Mobile banking is when you use an app on your smartphone or tablet to do your banking instead of going to a branch, using an ATM, or telephoning your bank.

You can't do everything with mobile banking. You can't withdraw cash, for example, but many other tasks are much easier to do with your mobile phone than in person.

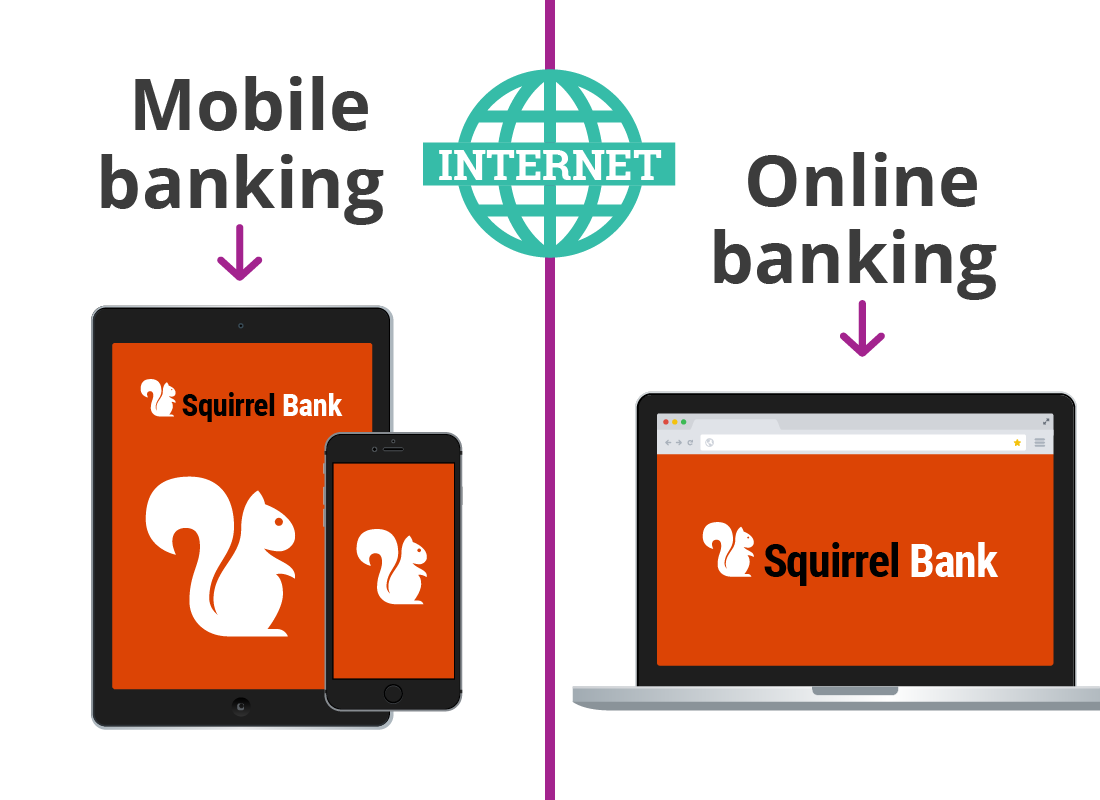

Is mobile banking the same as online banking?

Mobile banking and online banking are quite similar. Both allow you to conduct most of your banking needs without going to the bank, and both access your accounts over the internet.

However, mobile banking uses a special app from your bank, which is especially designed for the smaller screens on smart devices. Whereas laptop and desktop computer screens are larger, so for online banking, you use a web browser on your computer to access a special secure website made available by your bank.

You can learn more about online banking on your computer or laptop in our Introduction to online banking topic.

What do you need for mobile banking?

There are a few things you need for mobile banking. These include:

- a smartphone or tablet

- a mobile data or secure Wi-Fi connection to the internet

- a bank account that's been set up for mobile banking

- an active mobile phone number

- a mobile banking app installed on your device

- a passcode or PIN to log into your account.

How do you use mobile banking?

Your bank will have a special app for mobile banking, which you will have to install on your smartphone or tablet. Each bank uses a different app.

In the activities in this course we'll use a smartphone in our examples, but in most cases your mobile banking app can be downloaded to either a smartphone or tablet (or both), and should work and look much the same on both.

eSafety Tip

You should only install apps from an official store: the App Store for iPhones, or Google Play for Android phones.

To be extra certain that you're installing the genuine app, check the details that appear under the app. Your bank should be listed either under the app name (Google Play) or as the app Seller (Apple App Store). Thousands of reviews also mean the app is legitimate. Alternatively, you can click on the link to your bank's mobile banking app from its website.

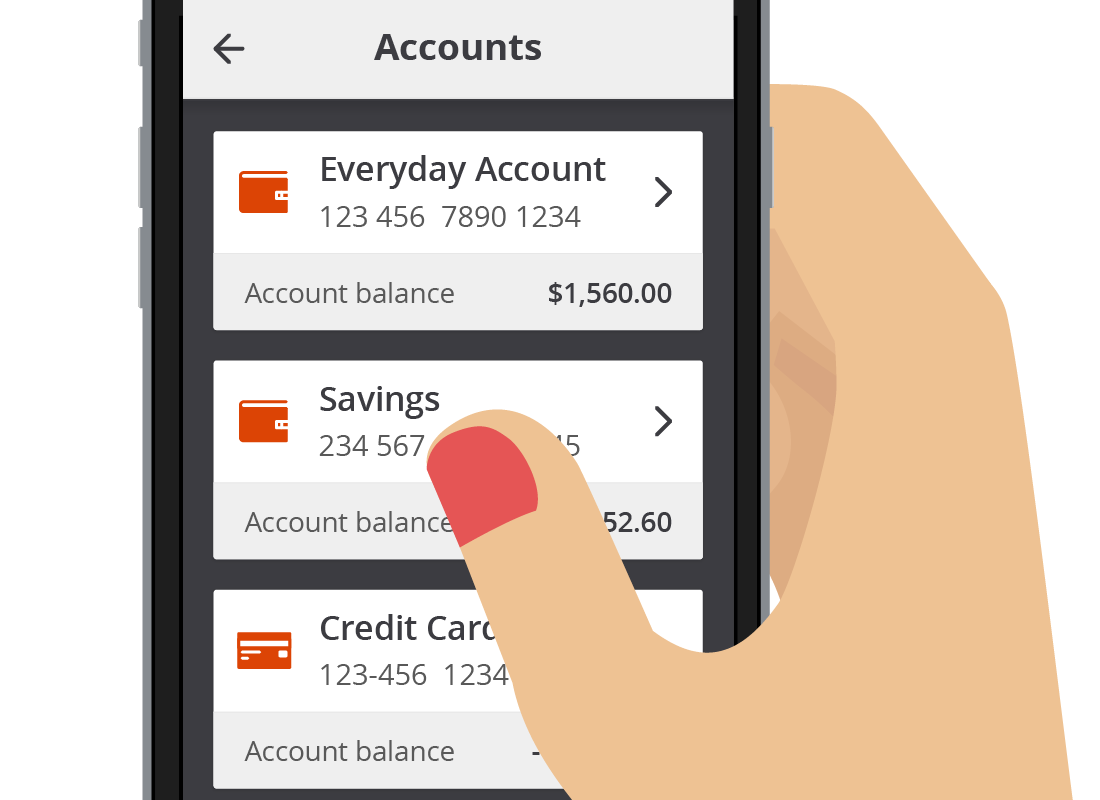

Connecting to your bank account with your mobile device

The banking app on your smartphone or tablet connects to your bank account through the internet.

The app and the connection it makes are extremely secure, and none of the information travelling over the connection can be intercepted, seen or changed by anyone. This makes it extremely safe to use.

eSafety Tip

Never connect your mobile device to public Wi-Fi networks for mobile banking. Once your mobile banking app is logged on, all your data will be secure. But there's the chance that someone could intercept your logon details while you are logging on using public Wi-Fi. If they do, they'd be able to logon to your account later.

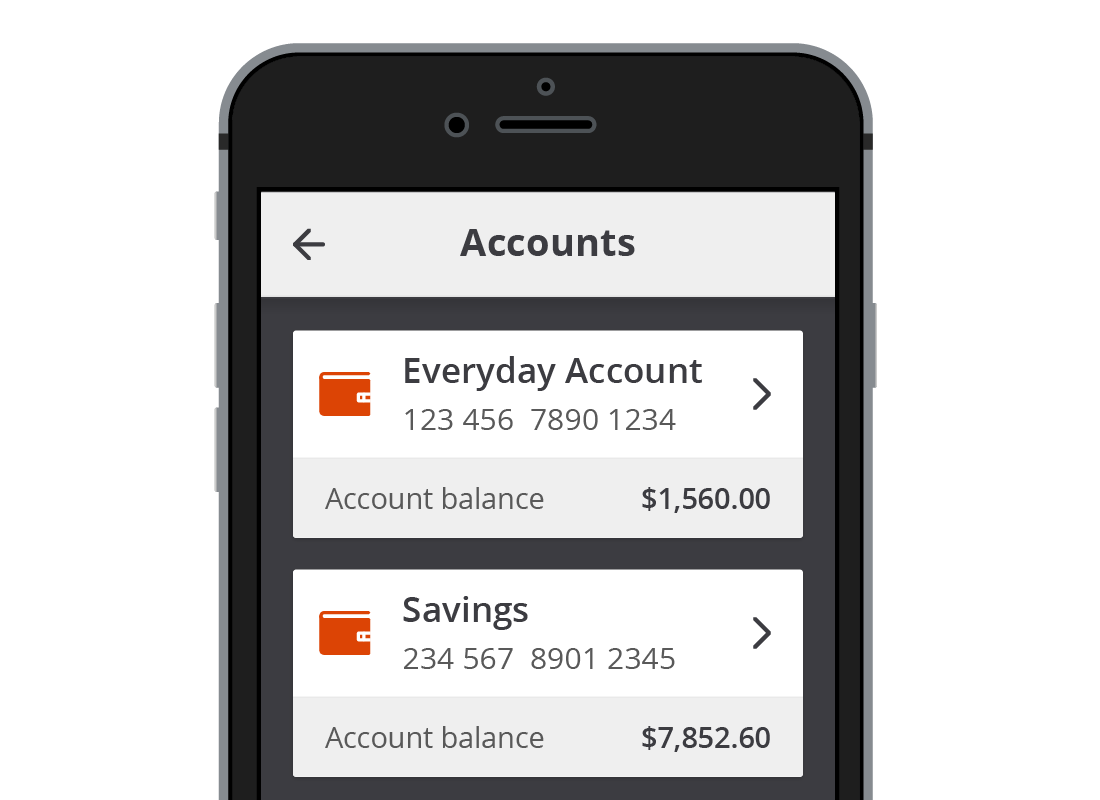

You do not need a special bank account

Your regular bank accounts are also your mobile banking accounts. With mobile banking, you will be able to see all the transactions and balances in your regular bank accounts on your mobile device at any time and in any place.

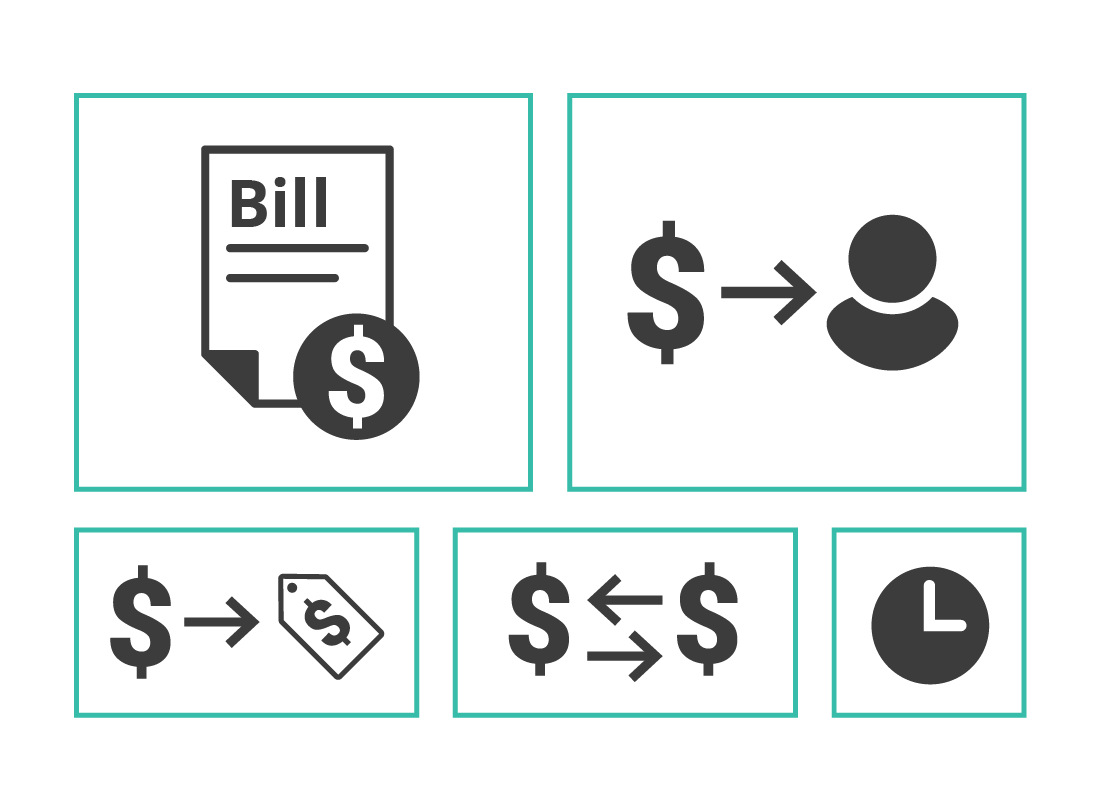

What can you do with mobile banking?

You can use mobile banking to do almost everything you need. You can:

- pay a bill

- send money to a friend

- buy something online

- transfer money between your accounts

- set up automatic bill payments or transfers so you don't have to do them manually.

If your transaction doesn't involve getting cash from the bank, you can probably do it with mobile banking.

Well done!

This is the end of the What is mobile banking? activity.

Next up, we'll find out why you should use mobile banking in The benefits of mobile banking activity.