The benefits of mobile banking

The benefits of mobile banking

What's coming up

In this activity, you'll learn about some of the benefits of mobile banking.

Mobile banking is very convenient, as it allows you to pay your bills easily, see your bank statements, and keep on top of your budget - anywhere and at any time.

Start activityAll your banking in one place

You can do just about all your banking using your mobile device. That means you can do it from home, or even while you're out and about.

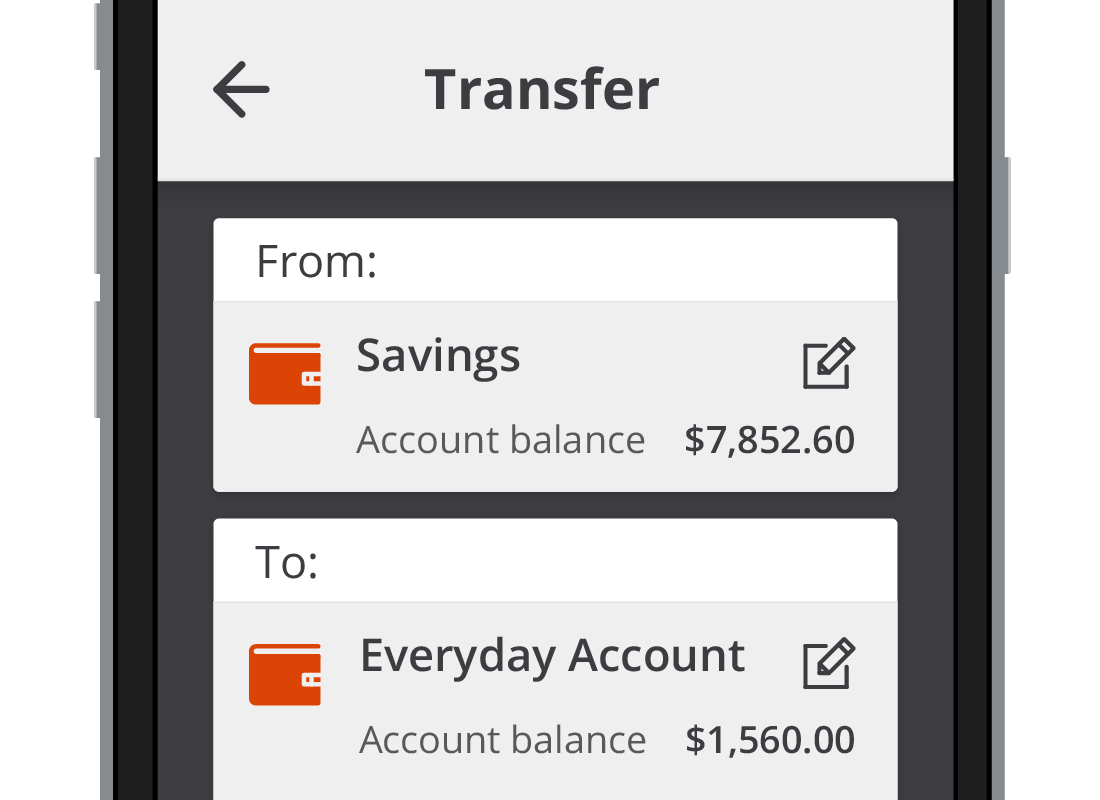

Whether its transferring money between accounts, paying bills, or sending money to other people, it's right there at your fingertips. You can also set up automatic bill payments, or savings transfers.

As long as you don't need to withdraw cash, mobile banking has you covered.

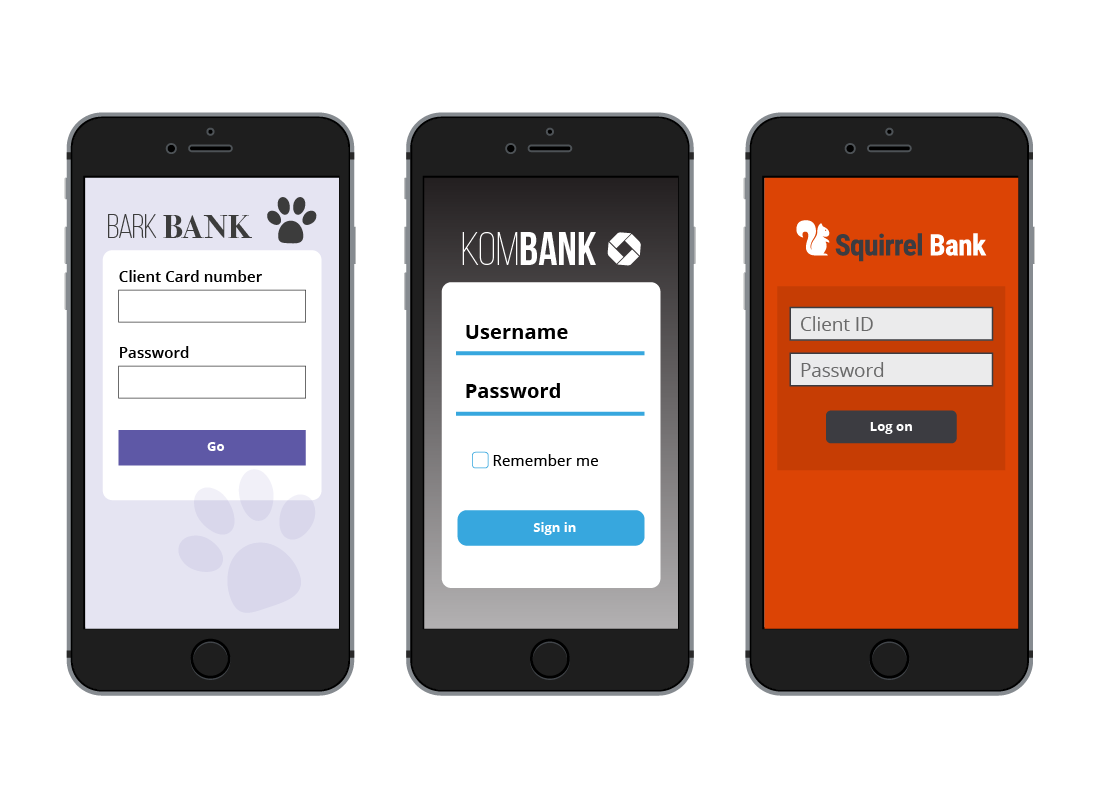

Different banks have different apps

Each bank's mobile banking app is organised a little differently and features can vary between apps. You will learn about some of the most common features available, but they may not be quite the same as your banking app.

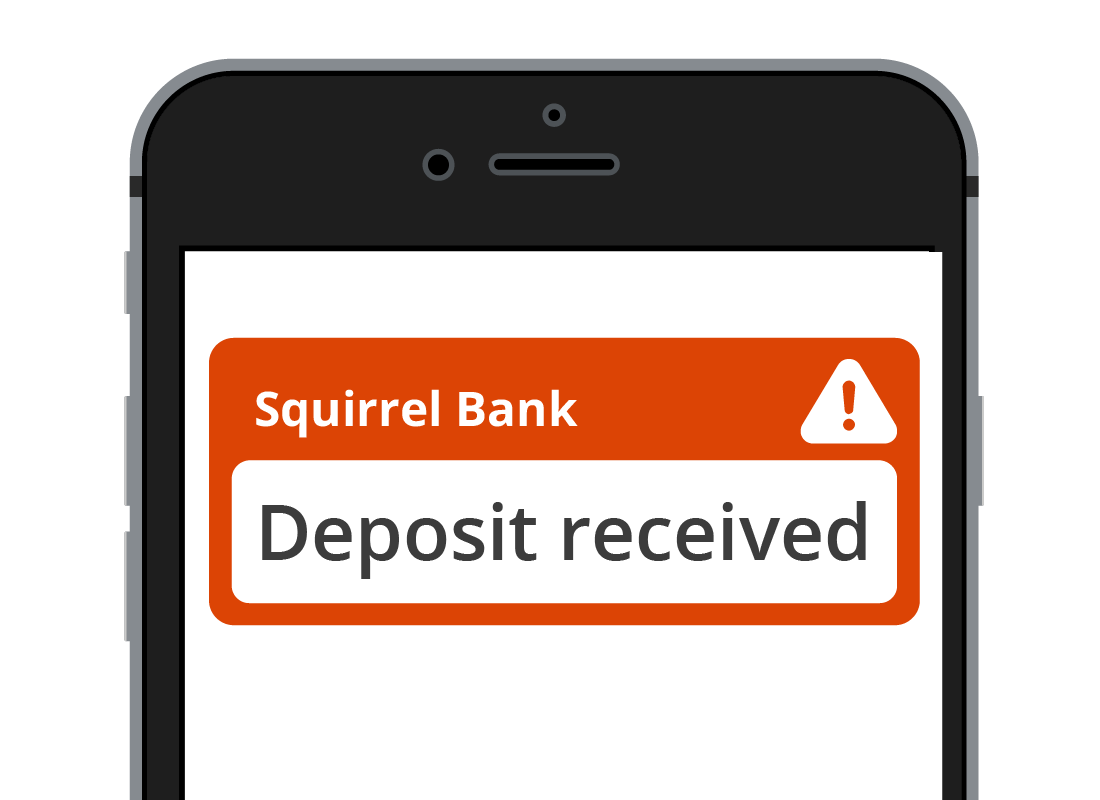

Receive notifications and alerts

Your mobile banking app can help keep you on top of what's going on with your bank accounts. Are you waiting for a deposit to be made, but unsure when it is coming? Some mobile banking apps will issue an alert, or notification, on your phone when a deposit is made, so you don't need to keep checking your balance.

Banks have different options for notifications that you can adapt to suit your needs, but most can provide you with useful reminders.

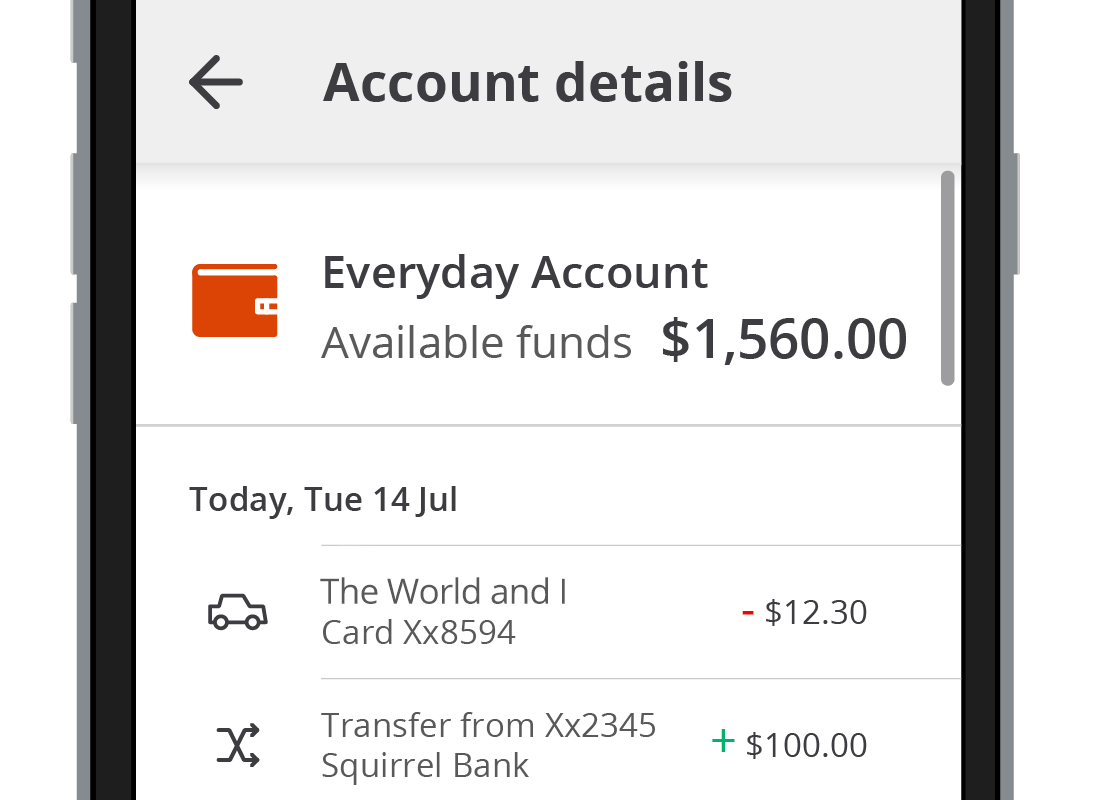

Check your bank balance at any time

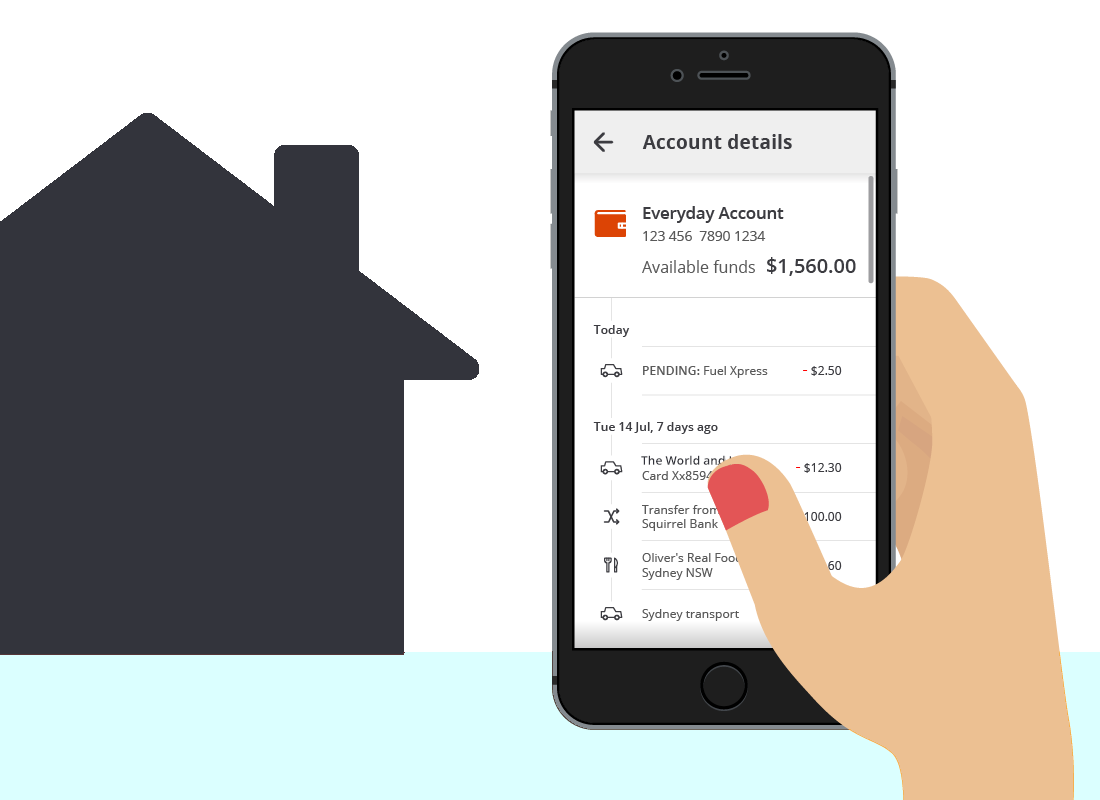

With mobile banking, you can easily check the balance of your bank accounts any time of the day or night. Some will let you see the balance of selected accounts without even having to enter your PIN. Don't worry, you have to switch on this feature in the app if you want to use it.

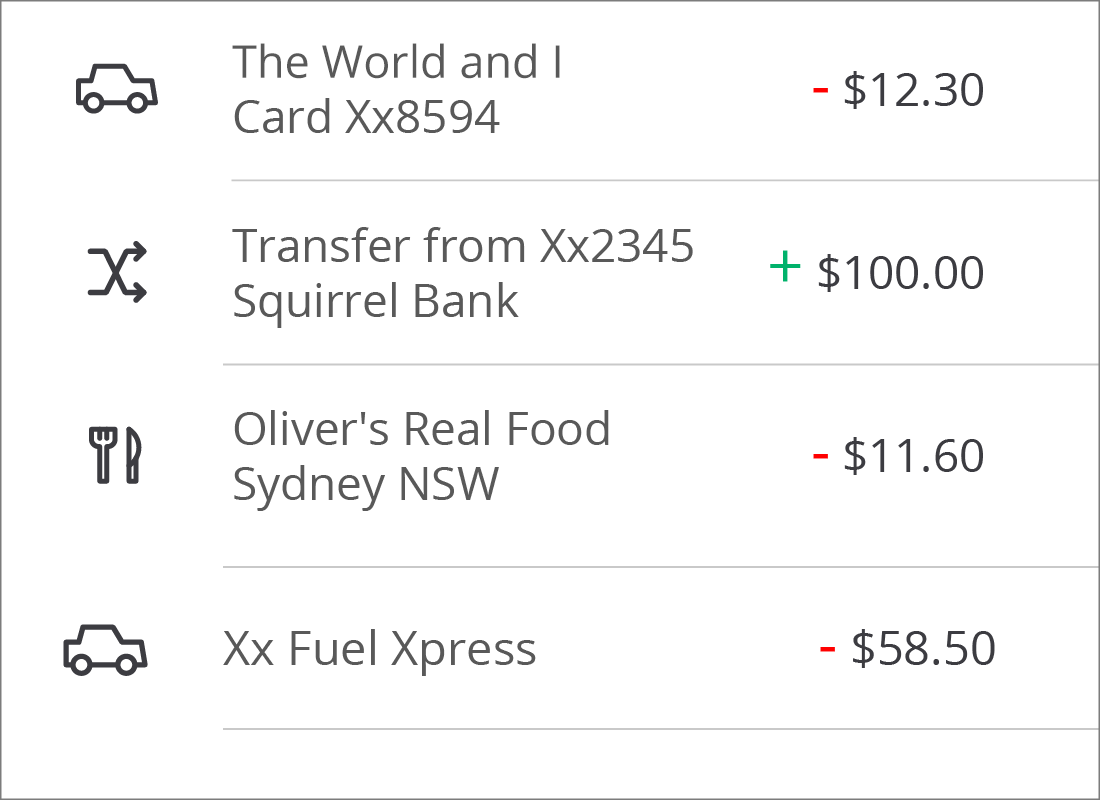

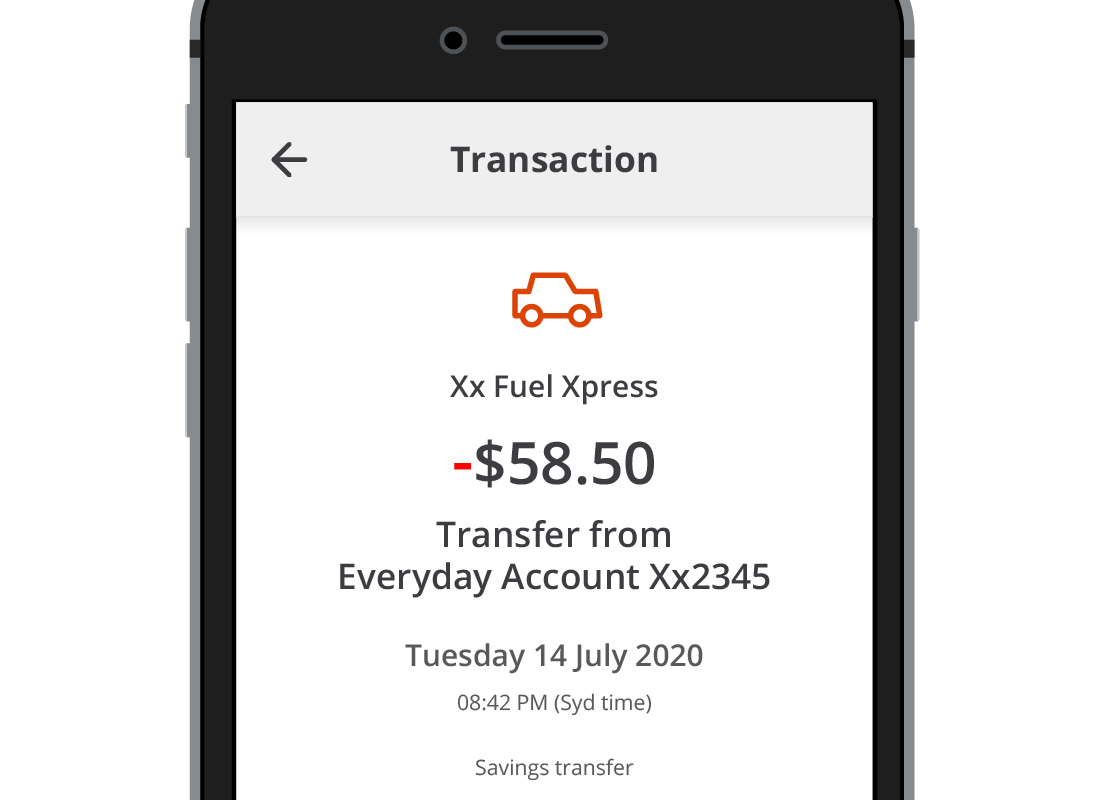

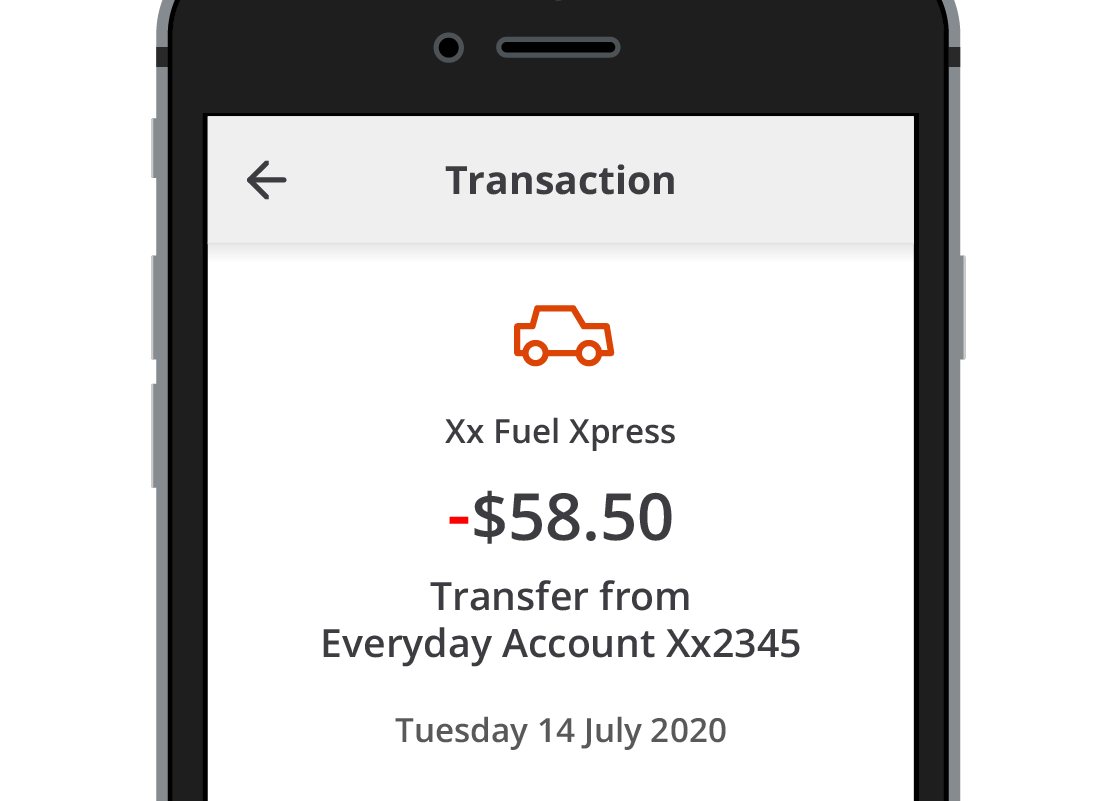

You can also check an account to see what transactions have been made. You can see whether funds have been deposited or refunded, and when payments have been made or cash withdrawn.

Control all transactions yourself

Mobile banking puts you in full control of your accounts at any time of the day, not just when the bank is open.

You can check that:

- payments have been made

- money owed to you has been received

- no unauthorised transactions have been made

- you are not making periodic payments for services you no longer need.

Keep on top of your budget

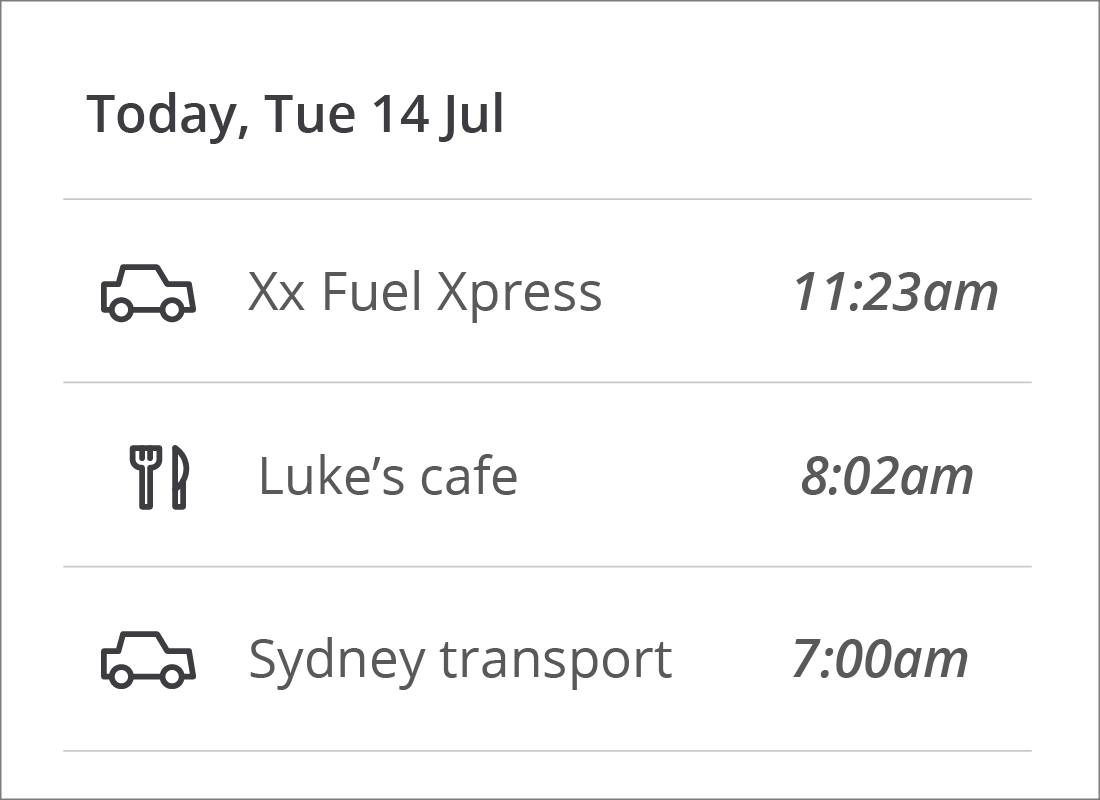

Most of us find it hard to remember all the things we've paid for. With mobile banking, each transaction has a date and a description of the store or service you purchased from, making it easy to keep on top of where your money is going.

Transferring money between accounts instantly

When you're out shopping, you may see an unexpected bargain. If you don't have enough money in your spending account, you can use mobile banking to instantly transfer the necessary funds from your savings account into the spending account.

Up-to-the-minute-information

Printed bank statements show transactions up to a specific date, but with mobile banking you can see account transactions right up to the moment. Sometimes, deposits and withdrawals appear in your transaction history within seconds.

Advanced security keeps your money safe

Banks have excellent security systems to make sure your money is secure when you're using mobile banking. Sometimes, you may need to re-enter your password or a code sent to you as an SMS by the bank to complete mobile banking tasks. These security features help to ensure no-one but you can access your money.

Well done!

This is the end of The benefits of mobile banking activity.

Next up, you'll learn how to stay secure when mobile banking in the Safety first for mobile banking activity.