How to identify an investment scam

How to identify an investment scam

What's coming up?

In this activity, you will learn how an investment scam works, step by step via a scenario. You’ll meet Bettina, who decides to invest in an opportunity that turns out to be a scam. You’ll see how the scammer wins Bettina’s trust, and how they convince her to invest more.

Start activityBettina is frustrated with her super

Bettina is nearing retirement and is frustrated with how small the returns are on her superannuation, which she needs to pay for her retirement.

One day Bettina is contacted out of the blue with a phone call offering her an amazing investment opportunity.

The scammer promises big returns

Bettina has been contacted by an investment company that claims to have special insight into a package of hot stocks that will give her massive returns. The scammers claim that Bettina will make 20% return in just a few months if she invests $50,000. The scammer sounds professional and seems to know what they’re talking about.

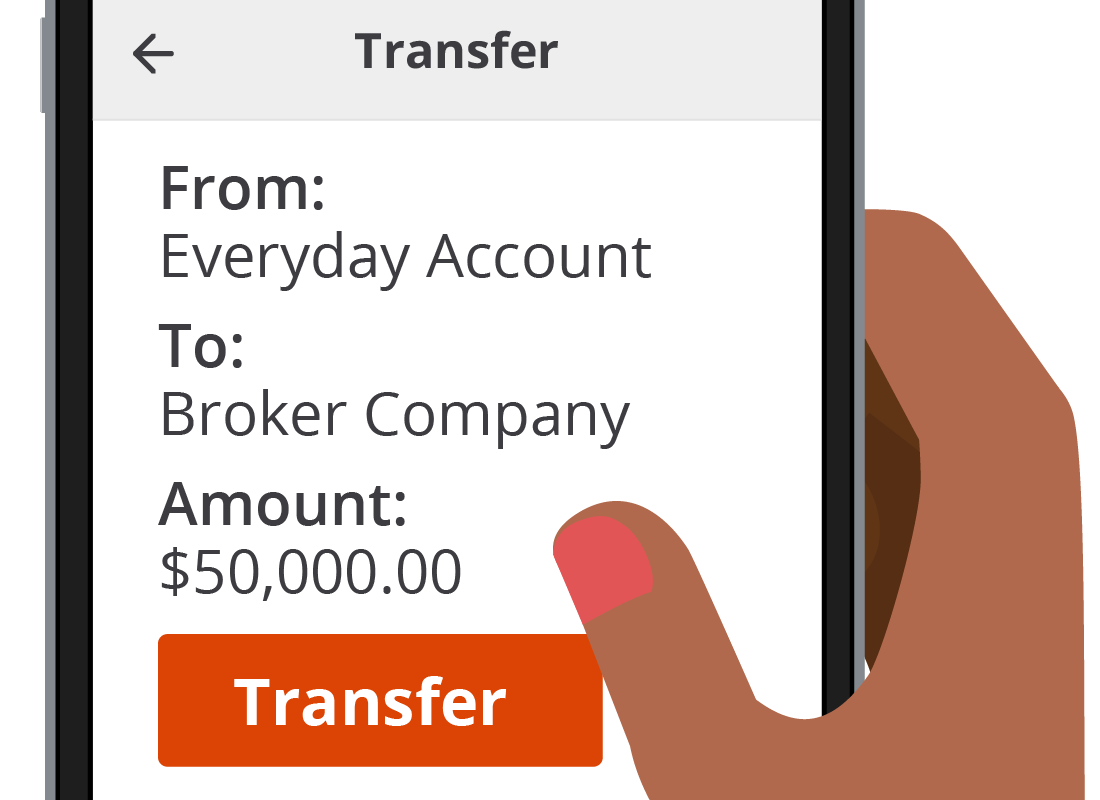

Bettina decides to invest

Since she has some cash savings, Bettina decides to invest in the scheme. She pays the scammer $50,000 via a wire transfer, and they provide her with some easy-to-use computer software to track her investment.

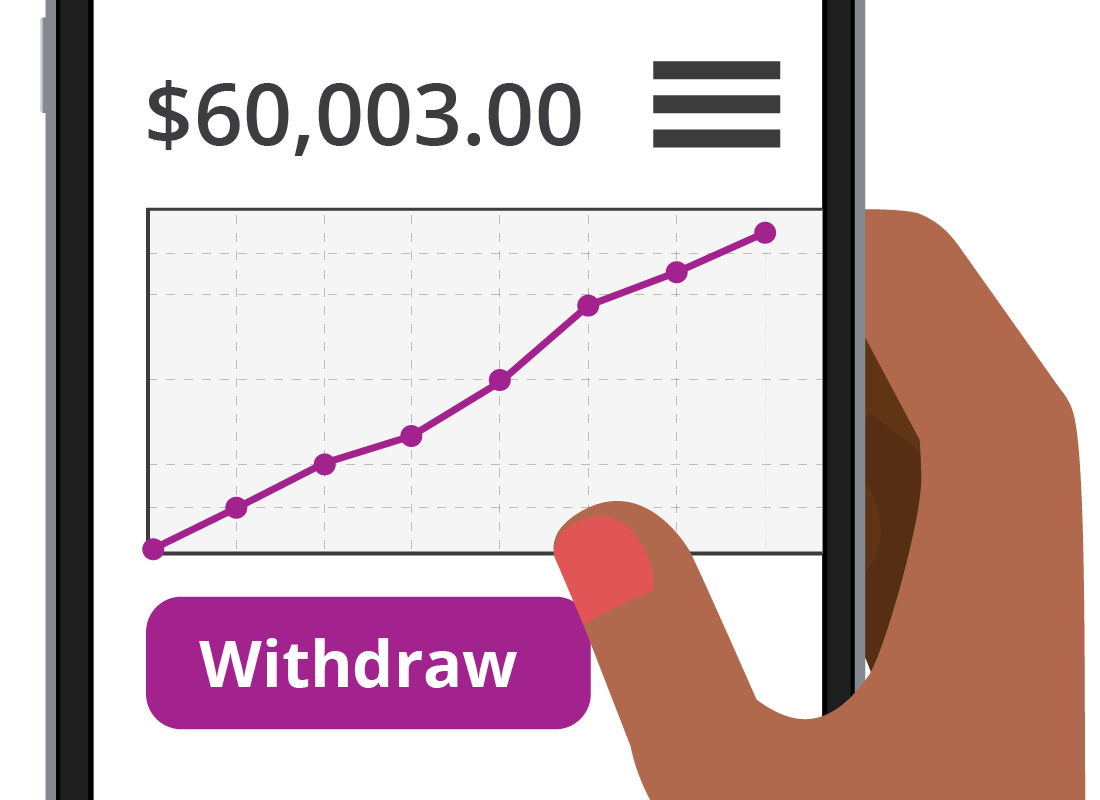

Bettina is pleased when after just a few months, the software reports that she has already made $10,000 on her $50,000 investment.

Bettina tries to withdraw her profits

Since she has a little bit of investing experience, Bettina knows it’s important to lock in profits. She decides to withdraw $8000 of the $10,000 gain, but when she tries the scammer calls her on the phone again. The scammer convinces her that instead of withdrawing her profits, Bettina should reinvest them and make even more money.

The scammer also claims that if Bettina waits until the new financial year before withdrawing any money, she will avoid tax. Bettina thinks this is a good idea and agrees.

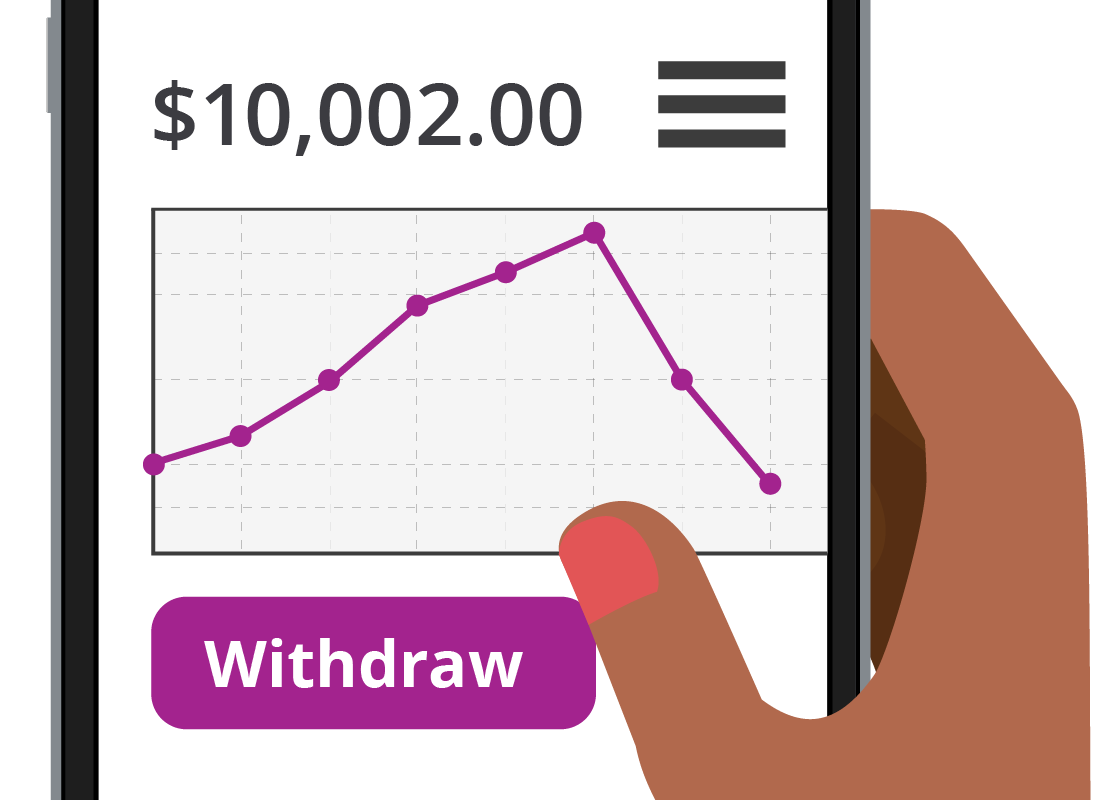

The value of Bettina’s investment falls

A week or so after Bettina reinvests, she loads up the investment tracking software and is shocked to see the value of her portfolio has dropped to just $10,000.

Bettina decides to cut her losses and at least get $10,000 back. She tries to withdraw the money, but nothing happens. When she tries to contact the scammer, there’s no response.

eSafety tip

Always keep in mind that if an investment opportunity offers very high returns with low risk, and seems too good to be true, it’s almost certainly a scam.

Bettina tries to contact the scammers

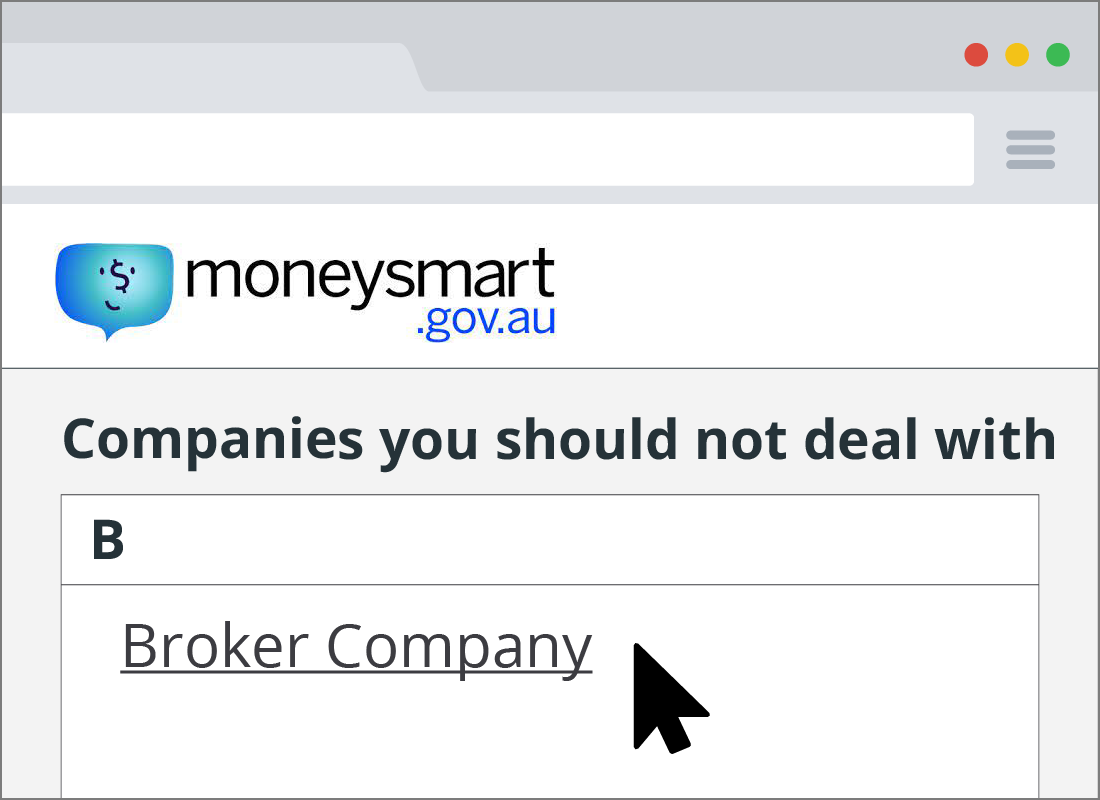

Bettina goes to the ASIC website to find more contact details for the scammer’s investment company. Instead, she is directed to the Moneysmart.gov.au website’s list of companies you should not deal with at https://moneysmart.gov.au/companies-you-should-not-deal-with

To Bettina’s dismay, the scammer she invested with is listed here.

Bettina’s money is gone

Unfortunately, because Bettina sent her $50,000 overseas to the scammer, it’s next to impossible for her to recover any of this money. The scammer has taken all the money from their victims and run.

Well done!

This is the end of the How to identify an investment scam activity. You’ve learned what an investment scam can look like, by following along with Bettina’s unfortunate experience.

Up next, you can find out how to avoid becoming a victim of these scams in the Protecting yourself from investment scams activity.