Safety first for online banking?

How safe is online banking?

What's coming up?

Your bank has great security systems for keeping your money safe, but there are still things that you can do to help keep your money safer.

In this activity, we look at the steps you can take to maintain your online safety.

Start activity

Protect your logon details

When you first set up online banking, your bank will give you a Client ID (this is your bank's version of a username) and ask you to choose a unique and strong password. You need to use this Client ID and password every time you want to log onto your bank account.

This is the first line of defence for your money, so it's very important not to share your Client ID or password with anyone else.

Protect your password

Some computer browsers have a feature where they offer to save your Client ID and/or your password for your bank's website, so that it will automatically fill these details in for you the next time you visit the website.

We recommend that you do not let your computer browser save your bank's client number and password, as anyone who has access to your computer will then be able to logon to your bank account. If your browser asks if you'd like it to save these details for you, choose the No or Never option.

Always log off!

When you've finished your online banking, make sure you always log off (sometimes called log out) of the website and, for extra security, close the tab in your web browser. This closes down your online banking session and the bank's web page, and is safer than just closing your computer.

eSafety tip

You should never use public computers or public Wi-Fi networks for online banking. The computers and Wi-Fi networks you can use in some libraries, airports and other public areas may not be secure, and there may be a chance that someone sees your personal financial information or your logon details.

Keep your phone secure

For some transactions, your bank might send a secret code to your mobile phone. You use the code to authorise what you're doing in your online banking session, such as making a payment. This added security process is sometimes called Two Factor Authentication or Two Step Authentication.

To see the code, you first need to unlock your phone. Making sure you have a strong passcode for your phone will help ensure no-one else can access those secret codes from your bank.

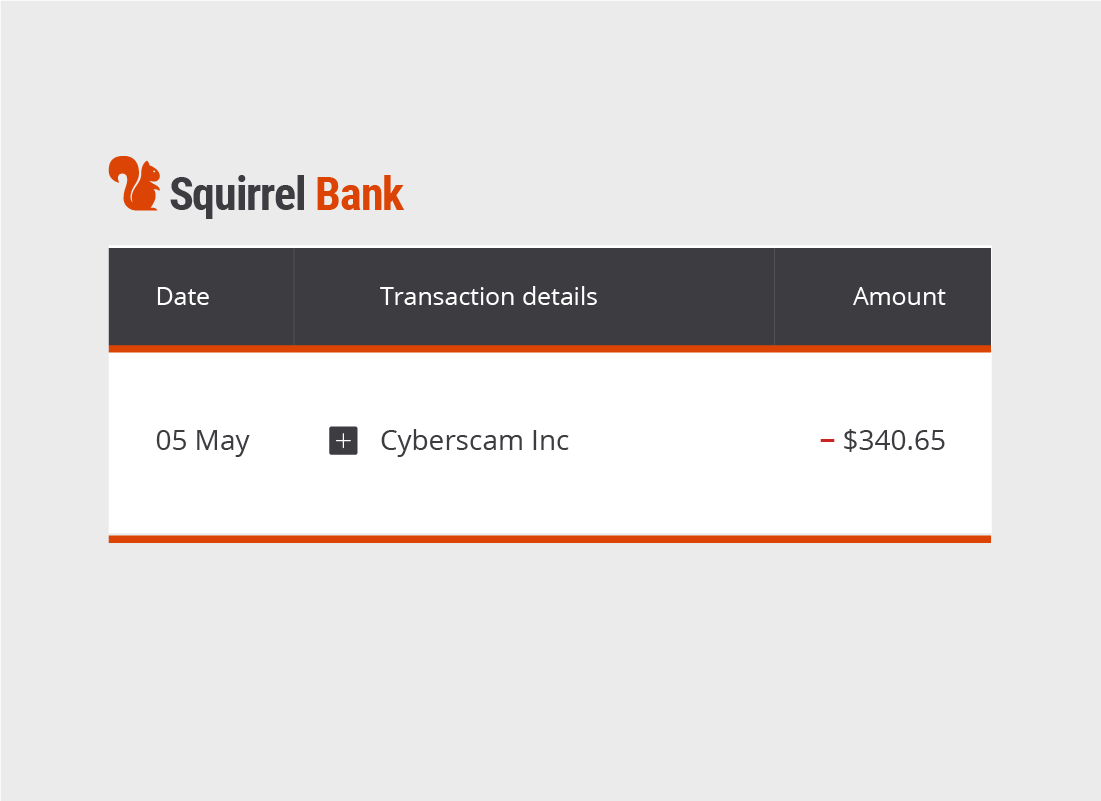

Check your balances

Keep an eye on the balances of your bank account. It's easy to do with online banking and you can quickly notice if there's an unexpected transaction.

If you see something that doesn't look right, call your bank as soon as possible to find out more.

Congratulations!

This is the end of the Safety first for online banking activity. You've learned that there are precautions we can all take to help keep our bank accounts safe and secure.

Next, we'll answer a few common questions about getting started with online banking in the Online banking FAQs activity.