General

What you need to know about tax and Medicare scams

It’s fair to say that when a government service like the ATO or Medicare asks for information, we generally oblige. Which is why tax and Medicare scams often work - we're used to giving out personal details to government services for legitimate reasons. Also, these types of scams play on our fears about breaking the law, being in debt or missing out on money owed to us.

In this guide we take a look at tax and Medicare scams, how to spot them, and how to protect yourself against them. The same advice can also be applied to scams claiming to be from myGov, Centrelink, and other government services. The scenarios may differ, but the rules remain the same.

We also hear about two real-life cases where scammers were successful in getting information or money from their victims.

In this article:

- How do tax and Medicare scams work?

- Tax scams: Mario’s story

- Medicare scams: Ellen’s story

- How to protect yourself against tax and Medicare scams

- What to do if you have been scammed

How do tax and Medicare scams work?

A scammer calls or emails you, claiming to be from the ATO or Medicare and tries to trick you into sending them money or providing personal identifying information such as your Tax File Number (TFN), Medicare number, date of birth, and bank or credit card details. A scammer may then use this information to steal your money, make false claims in your name or commit some other kind of fraud.

There are many ways a scammer may try to get money or personal information out of you. They may:

- ask you to pay a fee in order to get a tax refund or benefit

- threaten to arrest you or call the police if you don’t pay a debt

- ask you to update or verify your details in myGov

- ask you to send them copies of your personal identity documents like a driver’s licence or Medicare card.

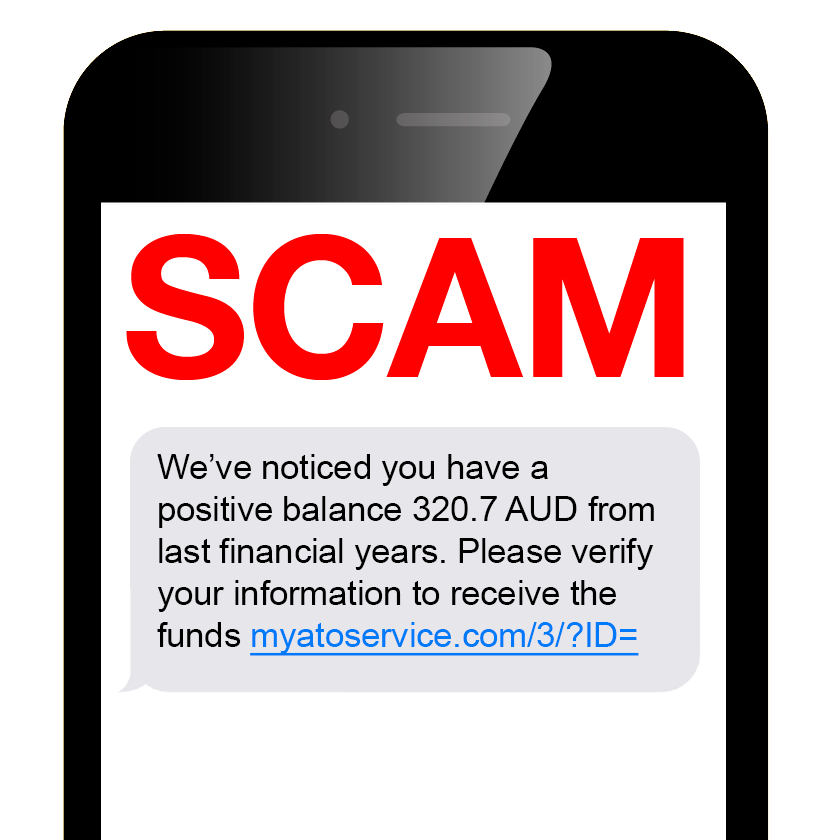

Example of a tax refund scam (ATO, 2020) Tax scams: Mario’s story

Mario is 58 years old and lives in the Western suburbs of Sydney with his wife. His adult children live nearby and his whole family is very engaged in the local Italian community.

One day he received a phone call from someone who said they were calling from the Australian Tax Office. The caller told him he had an outstanding tax debt of $3,948. Mario thought he had paid all his tax, but the caller insisted he owed the debt and that interest would be added every day he did not pay.

Mario felt pressured and scared when the caller became more threatening, telling him he could be arrested and go to jail if he didn’t pay the debt. The caller demanded he go to a petrol station and buy gift cards — iTunes and Google Play cards — to pay the debt. They sent him messages in WhatsApp demanding he send photos of the gift cards. It was only when they asked for more money that Mario realised it might be a scam and asked his son for help.

Signs this was a scam

- The payment method. The ATO - or any other reputable organisation for that matter - will never ask you to make a payment via any type of gift card, Bitcoin, or pre-paid Visa card.

- The caller’s aggressive tone and threat to arrest Mario and send him to jail.

- The use of WhatsApp to send messages. The ATO does not use WhatsApp to communicate with you.

What could Mario have done?

- Trusted his instinct. Mario thought he had paid his tax bill but the caller convinced him otherwise.

- Ended the call when he felt pressured and threatened by the caller.

- Called the ATO Scam Hotline on 1800 008 540 to check whether the call was legitimate or a tax-related scam.

Medicare scams: Ellen’s story

Ellen is 72 years old and lives in Adelaide’s southern suburbs. She regularly bakes Anzac biscuits for her granddaughter’s school canteen and loves taking her pet dog, Scottie, for walks around the neighbourhood.

A few months ago, Ellen received an email that looked like it came from Medicare. It had the gold and green Medicare logo as well as the logo for myGov. The email asked Ellen to update her Electronic Funds Transfer (EFT) details so she would continue to receive payments from Medicare. It warned that if she didn’t update her details, she may not receive her Medicare rebates.

Ellen clicked on the link to update her details. This took her to a site that looked like the myGov website but used the web address mygovau-update-details.net. She didn’t notice the address and logged in to the site. She entered her username and password and then answered a few security questions before updating her bank details.

A month later, Ellen noticed she wasn’t receiving Medicare rebates and her pension payments had also stopped. When she called Medicare and Centrelink, she realised her bank account details had been changed and her payments had been directed to scammers.

Signs this was a scam

- The email asking Ellen to update her banking details. myGov will never send you a text message, email or attachment with a link asking you to verify or update your details.

- The web address. The official myGov website is my.gov.au.

What could Ellen have done?

- Not clicked on the link in the email. Instead, Ellen could have placed the mouse cursor over the link to see the web address the link went to.

- Searched online for the official myGov web address to compare it to the one in the email. This would tell her if the myGov link in the email is the same as the official my.gov.au web address.

- Visited the myGov site by typing in the address, my.gov.au, to check her inbox for any messages from Medicare. Or called Medicare (on a phone number that she looked up herself, and not one in the message) to check whether they had sent her an email.

How to protect yourself against tax and Medicare scams

- Do not click on links. Government agencies such as the ATO and Medicare may send you a text message or email to provide an update on a matter you’ve been speaking to them about, or to ask you to contact them. However, they will never ask you to provide personal information by clicking on a link.

- Access the myGov website by typing my.gov.au into your web browser – don’t click on links claiming to take you to the myGov website. Agencies such as the ATO will never send you an email or text with a link to log in to the myGov website.

- Know legitimate ways to make payments — for example, the ATO or any other government agency will never ask you to make a payment via gift vouchers, Bitcoin or wireless transfers. You can find out more about how to make payments to the ATO by visiting their website www.ato.gov.au/howtopay.

- Be suspicious of requests for personal information — treat any request for personal information with caution. Call the government agency on their usual contact number to check if a call, email or text is legitimate, or check your myGov inbox.

- Know that you will never be asked to pay a fee in order to receive a payment or refund that’s owed to you.

- Be aware of current scams — check Scamwatch’s news and alerts and sign up to their scam alert emails.

What to do if you think you have been scammed

- Contact your bank immediately if you have given your bank or credit card details to a scammer. Your bank may be able to reverse the charge or stop any further payments.

- If you have paid money to a scammer, contact your local police to lodge an incident report.

- Contact IDCARE, a free support service for people who have been victims of scams: 1800 595 160 or www.idcare.org.

- If you think your personal details may have been changed or used by scammers, contact the relevant government service using their usual phone number.

If you'd like to learn more about scams, join our free online presentation Can you spot a scam?