General

How to protect your privacy online

Have you ever thought about the amount of information you give away online? Sometimes you can’t avoid providing your personal details, like when you make a purchase online, for example. However, for those times when it’s not necessary, it’s important to think about what you are sharing.

Online privacy shouldn’t be a cause for alarm. It’s simply something to be aware of so that you can practise good online habits. That way you can enjoy the benefits the internet has to offer with confidence.

The security rules we follow in real life should be applied to the online world too. Just like you would lock the door when you leave your home, it’s important to protect your personal information online too. Here are some steps you can take to help you do just that.

In this article:

- Passwords: make them strong and secure

- Don’t share more information than you need to

- Review your apps’ permissions

- Pay for things securely online

- Be aware of phishing scams

- Switch to a private web browser

- Update your software

- Use a secure connection

- What to do when your personal information has been compromised

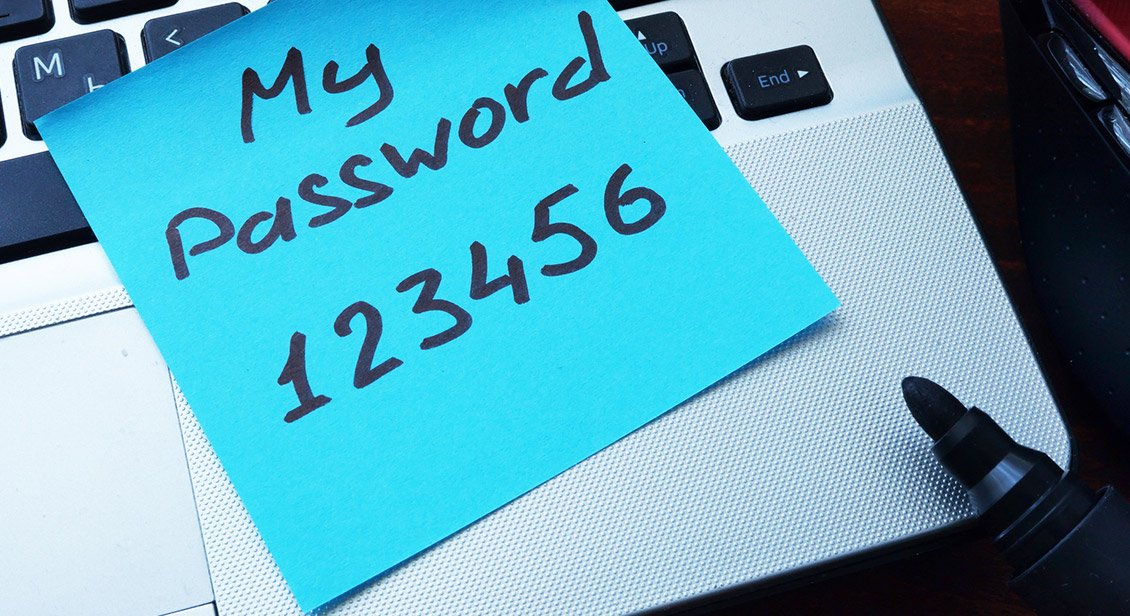

1. Passwords: make them strong and secure

Weak passwords like ‘Password1’ and ‘12345’ take hackers less than a second to guess. If you want to protect your personal information, start by creating strong and secure passwords for all your online accounts. The longer the password, the harder it is for others to guess.

The best type of password is a jumble of numbers, letters and symbols. However, these passwords are also hard to remember. To make things easier, create a passphrase from something like a memorable trip or event by using the first letters of that phrase and adding symbols and numbers.

For example, let’s say you went to Paris in 2016, you could form a password like: Iw2Pi16! (I went to (2) Paris in 2016). This is much harder to guess.

Another option is to use a Password manager so it remembers all your passwords so that you only need to remember the one master password.

3. Review your apps’ permissions

Some apps ask for unnecessary permission unrelated to their function. For example, a weather app does not need access to your contacts list or microphone for you to check the weather.

You can review permissions you’ve given to the apps on your smartphone in your Settings menu. Scroll down until you see a list of all the apps on your phone, then tap on each app to see what permission you’ve given and adjust accordingly.

Consider changing permissions in apps to ‘while using the app’, instead of ‘always’. Also, if you are no longer using an app, it’s best to delete it. Find out more about managing and deleting apps.

4. Pay for things securely online

The safest way to pay for things online is by PayPal or your credit card. PayPal provides an extra level of protection because it allows you to pay without having to share your banking or credit card details with the online seller.

When you use PayPal to pay for something, the online seller automatically redirects you to the PayPal site where you can sign in and approve the charge. PayPal then quickly redirects you back to the online seller to receive your order confirmation details.

Before you purchase something online, make sure the website is legitimate and secure. Before you pay, always look for the ‘https://’ (the ‘s’ stands for secure) and the closed padlock in the address bar.

It’s best to also stick to well-known websites that have a good reputation. If you’re unsure about a particular website, check the online reviews and look for things like the number of reviews (the more the better) and how recent they are.

Find out more about how you can stay safer when buying things online.

5. Be aware of phishing scams

Phishing scams trick people into handing over their personal details by pretending to be from an organisation they recognise like a bank, internet service provider or government agency. So read text messages and emails carefully before clicking on any links.

Scammers use different tactics to get your details. They may create a sense of urgency by telling you there has been suspicious activity on your account or that you have been locked out of your account.

Do not click on links in messages asking you to update or verify your details - legitimate organisations will not send you a message asking you for such information. If you’re unsure about a message you’ve received, call the organisation direct. Don’t use the phone number in the message, instead search for the phone number online.

Find out more about various scams and how to avoid them.

6. Switch to a private web browser

Some web browsers like Google and Bing track your activity online to be able to present you with more targeted ads. It’s why when you search for something online, you see it advertised on the next website you visit.

Some people don’t mind seeing more relevant or personalised ads, however if you don’t want to be tracked around the internet, you can switch to a web browser that doesn’t collect or share your data.

Search engines like DuckDuckGo and Ecosia let you search anonymously on the web. They don’t track your activity, sell your data to advertisers or permanently store your search history.

Find out more about alternative search engines to Google.

7. Update your software

Computer and phone manufacturers are always working to fix bugs and vulnerabilities that cyber criminals love to exploit, especially in older software. So when a software update on your device becomes available with a new feature or security update, be sure to accept it.

8. Use a secure connection

Avoid using public Wi-Fi to do anything that involves entering personal information like your address or banking details, even if it is a secure website. Public Wi-Fi networks that you find at cafes, libraries or airports don’t have the same security levels as your Wi-Fi at home. Public Wi-Fi is best suited for things like reading the news, general browsing and watching or listening to something online.

What to do when your personal information has been compromised

If you think your personal information has been misused or you have provided personal information or money to scammers, there are some steps you should take:

- Speak to IDCARE on 1800 595 160 or visit the IDCARE website . They’re a free support service that can provide advice when it comes to things like identity theft, hacking, scams and lost or stolen credentials.

- Immediately contact your bank if you think scammers have your financial details. Your bank may be able to reverse charges and/or block future ones.

- Change your passwords on the accounts you think might be affected, especially where you have used the same password for several accounts.

- Report and stay on top of current scams and alerts at Scamwatch .