Mobile banking FAQs

Mobile banking FAQs

What's coming up?

If you are new to mobile banking, it's normal to have lots of questions. In this activity, we'll answer some of the most frequently asked questions.

Start activityHow can I be sure it is safe?

Banks have your security as a priority. There are consumer laws about how they must protect you, and systems that help keep your funds and information safe.

For example, access to your mobile banking is kept safe by your phone's security system and you require a PIN or your fingerprint to access your accounts. Sometimes you will have to enter a security code that the bank sends to your phone to authorise a transaction. Other times you will have to authorise a payment with the PIN or your fingerprint.

Your bank also minimises risk by limiting the amount of money that can be taken from an account, and monitors accounts for out-of-the-ordinary transactions.

What if I make a mistake?

Your bank maintains customer service telephone lines to help you if you have a problem. The number will be on your bank's website and in the banking app. Look for the Contact Us button or entry in the app's menu.

Many banks also have a Chat feature on their website, where you can type your question to bank staff and they can type back their response. That way you can keep a record of the conversation. Look for the Chat icon on the screen, or in the Contact Us section.

eSafety Tip

When you're transferring money to someone, always double-check the details. Especially check the account number and the BSB of the person you're transferring the money to. Be careful to enter the numbers without spaces or dashes.

If you enter the wrong numbers, you may not be able to get the money back.

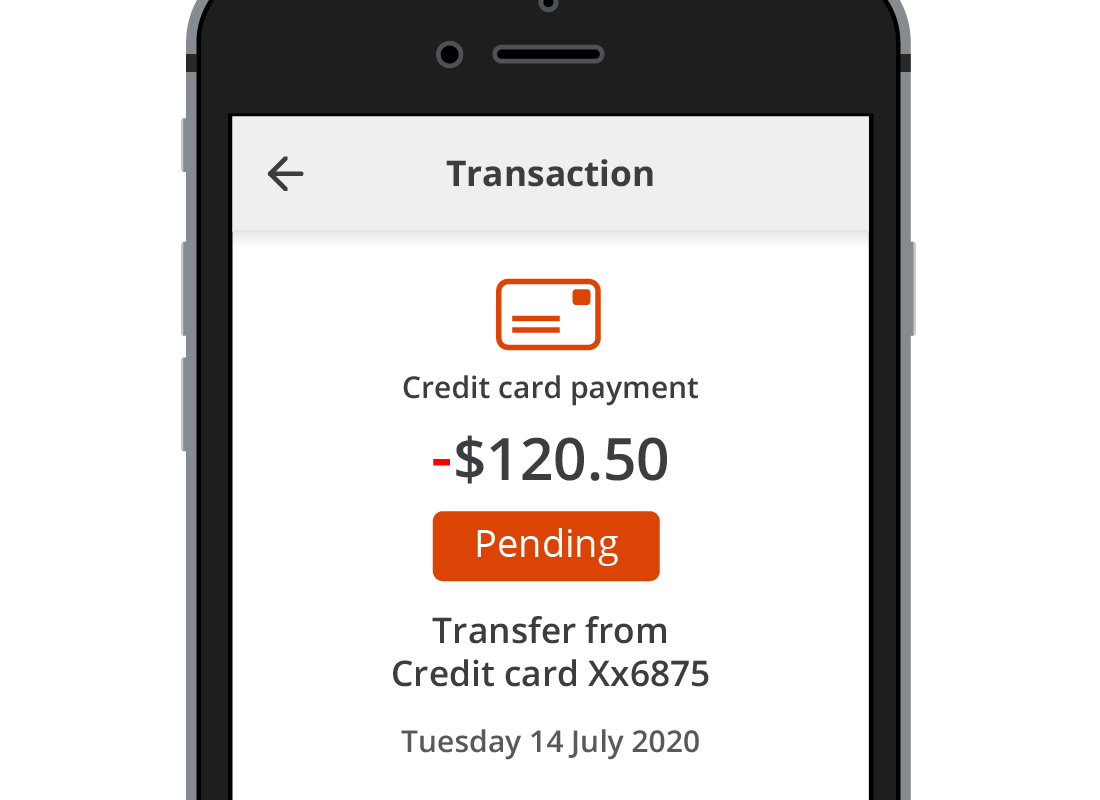

How do I know a payment has gone through?

You don't have to wait for your monthly statement to see if your payments have been made. With mobile banking, you can see all your transactions within moments. Sometimes, it may take a few days to process the transaction. Those transactions will usually appear as Pending or something similar.

If you're worried about an important transaction, just call your bank's help line.

What if I think someone knows my password or PIN?

You should always keep your online banking password and mobile banking PIN secret. Never share them with anyone.

If you suspect that someone knows them, you can get help to stop them from accessing your accounts any time, day or night.

Your bank has a contact telephone number for any security worries you have. Call this number straight away to make sure no one can use the password or PIN. You can arrange for a new password or PIN while you're on the call.

How can I report a scam?

You may be contacted by someone pretending to be your bank, but who is actually trying to steal your money. One of the most common ways is an email that looks a lot like it's from your bank. Most banks will never send you an email containing a link. If you're unsure about an email, do not click on any links in it.

If you think someone is trying to scam you, find the Report a Scam link on your bank's website. It will usually have an email address that you can forward scam emails to. Alternatively, look up the bank's contact phone number and give them a call. Your bank will appreciate you checking with them.

eSafety Tip

Your bank will never ask for your PIN or password, so do not provide these if an email that looks like it's from your bank asks you to update your details.

Can I still get paper statements?

With mobile and online banking, you have options for accessing and managing your bank statements.

You can have them posted to you if you prefer, but the bank may charge you.

Your mobile banking app may let you change some settings for your statements, but you usually can't see statements within the app. Instead you can see the transaction list in an account. Use online banking on your laptop or desktop to read or download the real statements.

Well done!

This is the end of the Mobile banking FAQs activity.

Next up, let's check some steps you can take to be certain that your online accounts are safe in the Tips for safer mobile banking activity.