Safety first for mobile banking

Safety first for mobile banking

What's coming up?

Your bank has great security systems for keeping your money and information safe, but there are things you can do to help as well.

Don't worry, it's easy to do your mobile banking safely. In this activity we'll show you how.

Start activityProtect your logon details

In the next course, Setting up mobile banking, we'll see that you should set up online banking in order to use mobile banking on your mobile device. When you do that, your bank will give you a client number and a password which will provide access to both online and mobile banking. Anyone who has these can access your bank accounts, so never share them with anyone.

eSafety tip

If you are banking using your mobile phone or tablet, it is important to keep it secure. That means having a good lock on your device. For added security, use a PIN or fingerprint or facial recognition to unlock your phone.

You can learn more about keeping your phone secure in the Android phone: Security and privacy activity or in the iPhone: Security and privacy activity.

Logging into mobile banking

Once you log into mobile banking for the first time using your full logon details, you will be able to set up faster ways of logging into the app. The methods that can be used to access mobile banking depend on the app, but they include:

- a PIN

- fingerprint or facial recognition

- keypad swipe patterns

- voice identification.

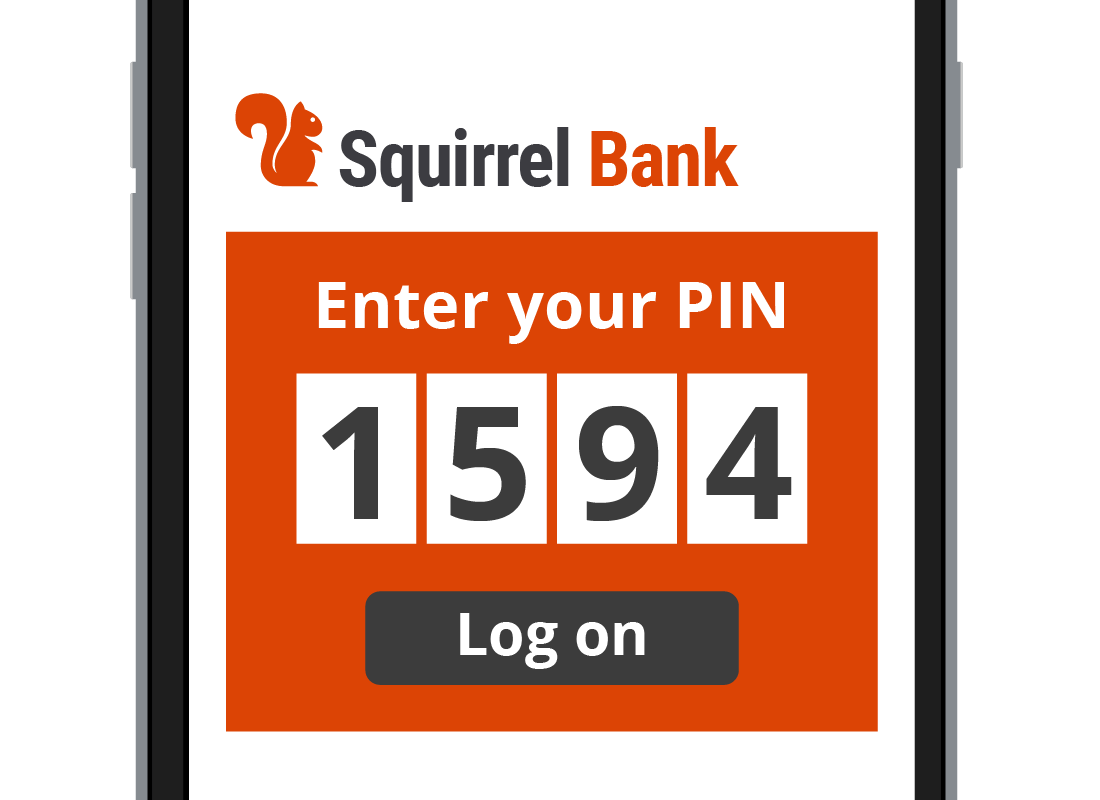

Protect your PIN

The PIN you use to access mobile banking is usually a four- to six-digit number. Once you've set this up, you will be able to enter mobile banking very quickly.

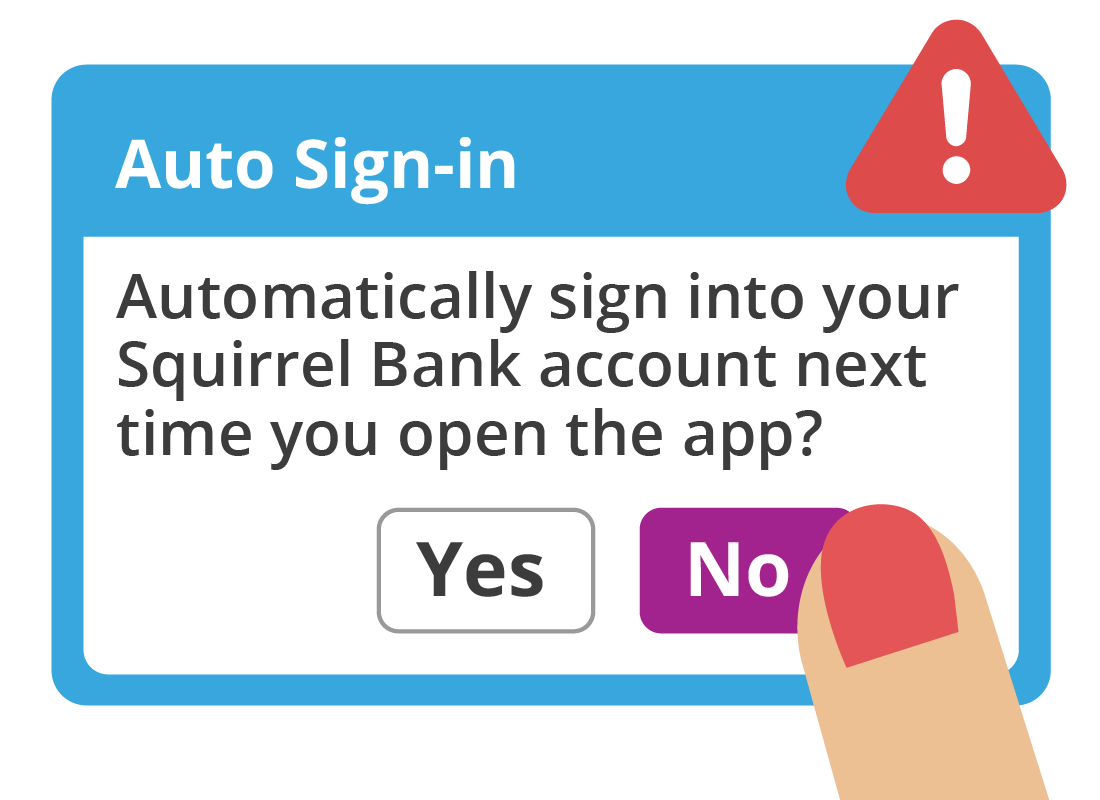

If your phone ever offers to save your PIN, say no. If you do, anyone who manages to get hold of your phone while it is unlocked will have access to your bank accounts.

Always log off!

When you've finished your mobile banking session, it's always safest to log out of the app properly using the Log off/Log out button in the app, if one is provided. If you just exit the app to your mobile device's Home screen, the app may remain open and logged on in the background. Your mobile banking app will log off automatically after a while anyway, but it's best to make sure.

Watch out in public places

Never connect your mobile device to public Wi-Fi networks for mobile banking. Once your mobile banking app is logged on, all your data will be secure. But there's the chance that someone could intercept your logon details while you are logging on using public Wi-Fi. If they do, they'd be able to logon later.

Your bank helps keep your mobile banking secure

Sometimes your bank might send a secret code to your mobile phone via SMS. You use the code to confirm something you're doing in your mobile banking session, such as making a payment. This is often called Two Factor Authentication and it helps your bank confirm that it really is you using the app.

The SMS will usually display the first couple of lines of the text on the screen when it arrives. If you can see the code, you can enter it right away. If it disappears too quickly, you will need to switch to your SMS app to see the code, and then switch back to the banking app to enter it.

Check your balances

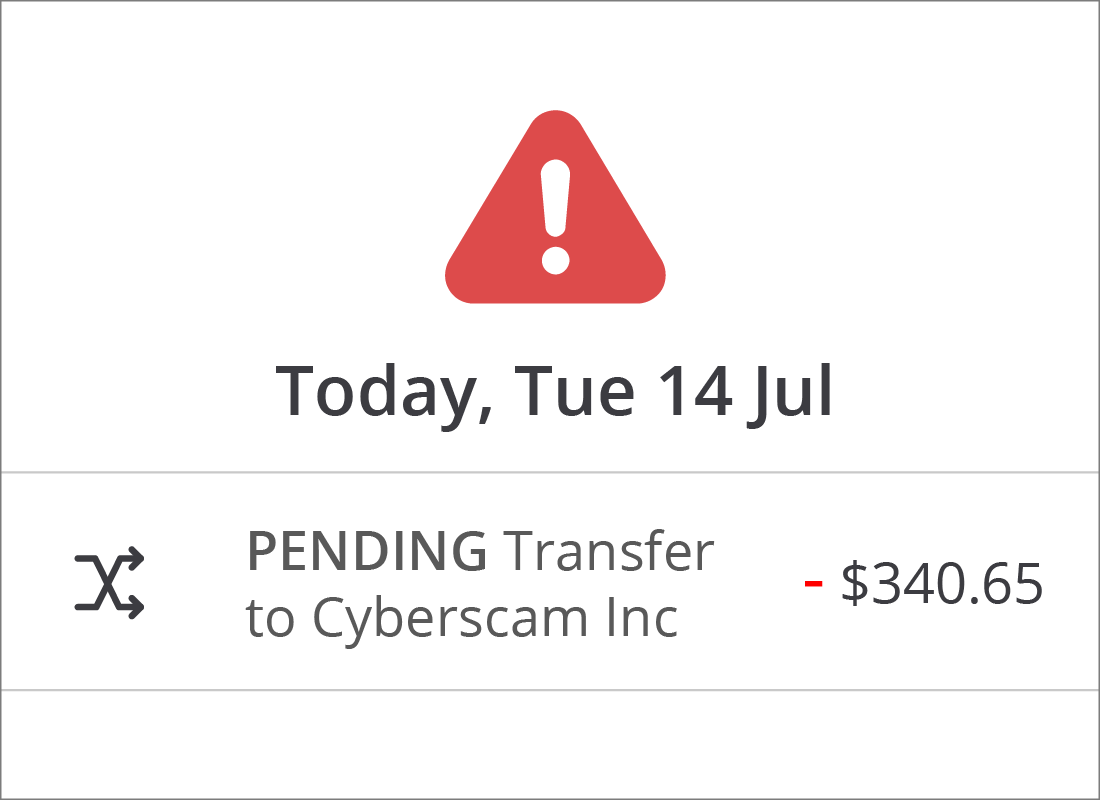

Keeping an eye on the balances of your bank accounts is easy to do with mobile banking, and it allows you to quickly notice if there's an unexpected transaction.

If you see something that doesn't look right, call your bank immediately to find out more.

Well done!

This is the end of the Safety first for mobile banking activity.

Next up, we will answer a few frequently asked questions about mobile banking in the Mobile banking FAQs activity.