Using a mobile banking app

Using a mobile banking app

What's coming up?

In this activity, you will learn about the tools you need to do mobile banking, and the basics of how to use them.

Start activityWhat do you use to do mobile banking?

You do mobile banking with an app on a smartphone or tablet. For this activity, we'll illustrate mobile banking using a smartphone, but the tablet experience is very similar (if not identical), so you will still be able to follow along.

What does it mean to bank with an app?

An app on your mobile device is simply a program, or application, that does a specific job. A mobile banking app is designed to connect securely to your bank account. You will need to install the app made available by your bank onto your mobile device. It can be obtained for free from the App Store if you're using an Apple iPhone or Apple iPad, or the Google Play Store if you're using an Android phone or tablet.

Logging on to mobile banking for the first time

Each bank's app will vary in look and the functions it performs, but don't worry, as they all work in a similar way.

The first time you log on to your accounts with your mobile banking app, it will ask for your Client ID and password. Your bank will have provided these when you first set up online banking.

However, entering a lengthy Client ID and password on a mobile device each time you want to use the app can be fiddly, so mobile banking apps provide faster, easier ways to log on after the first time. Let's look at two options next.

Logging on after the first time

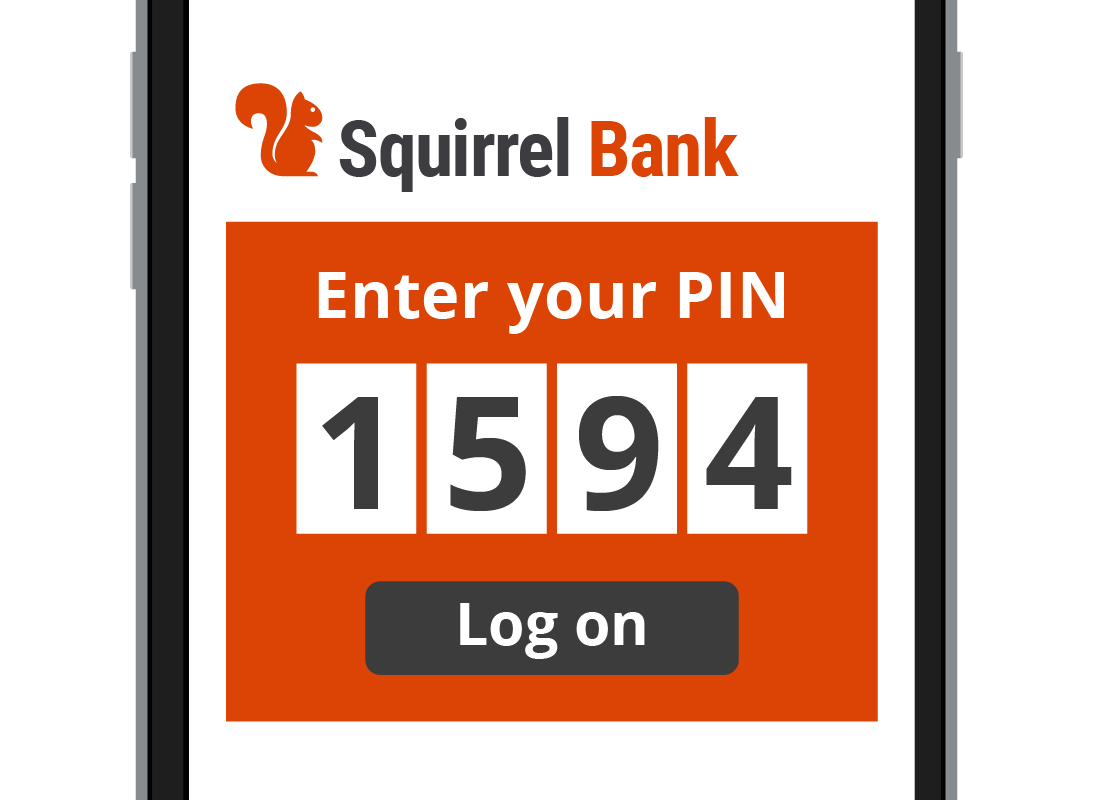

Your bank's app will remember your Client ID from the first time you use it, so from then on, you will usually be able to use one or both of the following alternatives to prove your identity:

- A PIN, short for Personal Identification Number, usually a four- to six-digit number that you create.

- Biometric security, which means the device can identify you physically, such as with a fingerprint or by facial recognition. Not all devices have this capability however, so it does depend on the type of device you are using.

If your banking app doesn't prompt you to choose a PIN, fingerprint or facial recognition automatically, you can usually find these options in the app's settings.

Exploring your mobile banking app

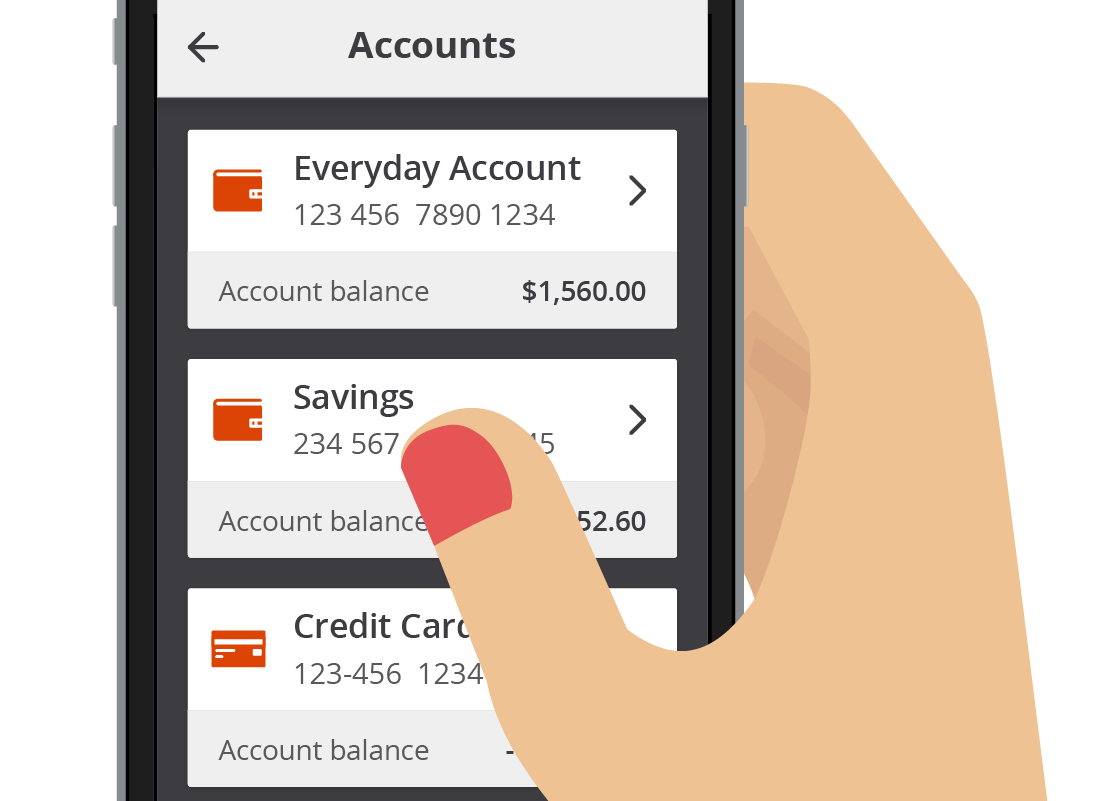

When you first log in to your app, you will likely see a list of accounts with their balances. You can see a list of transactions for each account simply by tapping on it.

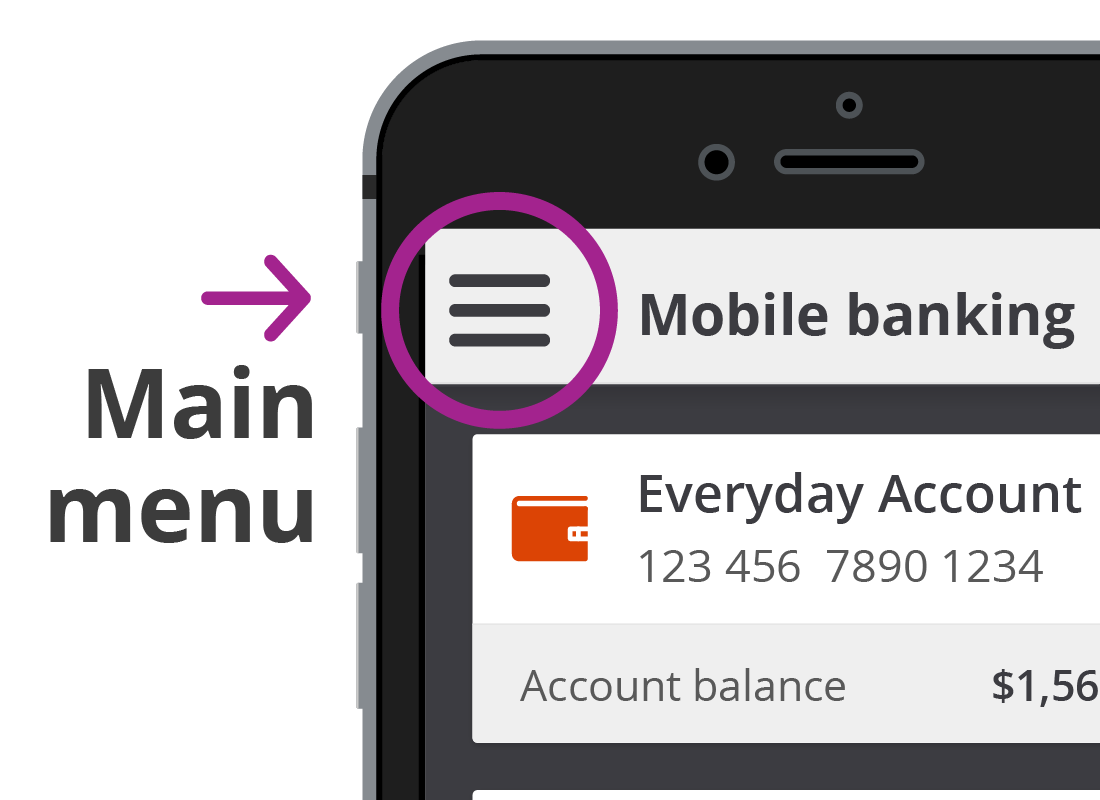

The main menu button will look like three stacked horizontal lines, or perhaps three dots. Tap on it and you will see more options, for transferring money, making payments, adjusting your settings and a whole lot more.

New ways to pay with mobile banking

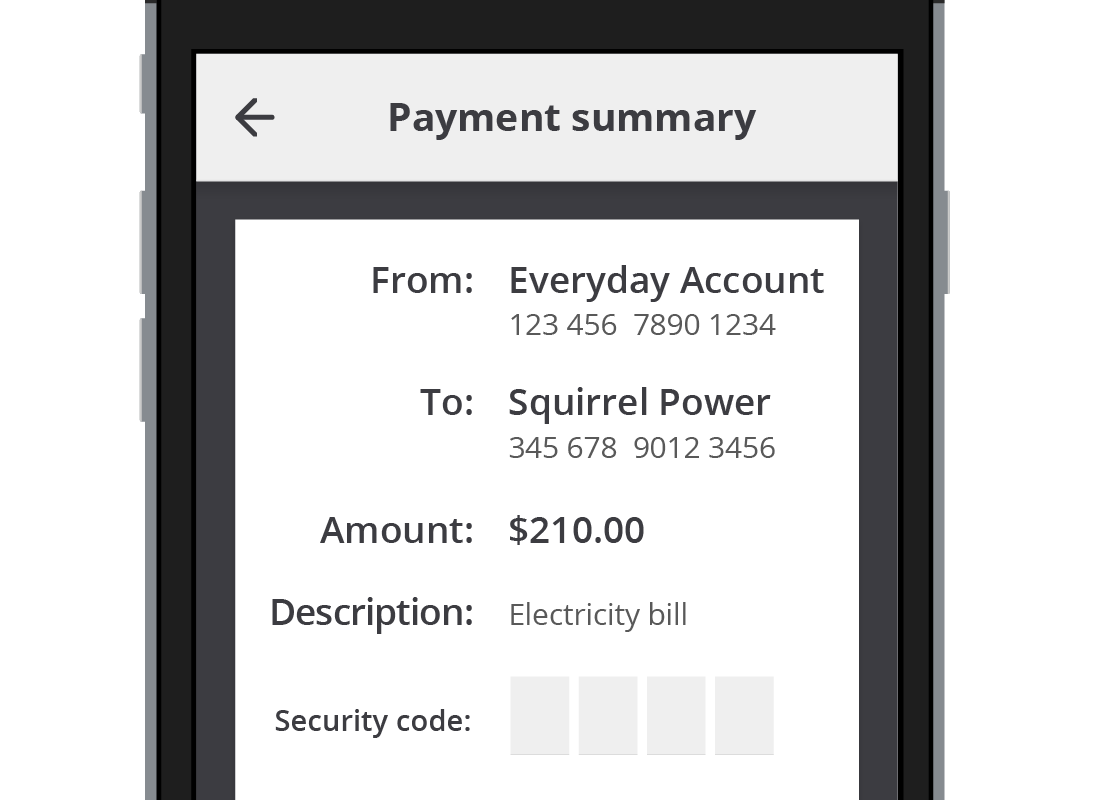

There are several ways to pay people and businesses using mobile banking. By far the most common way is by transferring money to them using their bank account number and BSB details. The money is transferred into their bank account, often within minutes or seconds.

Well done!

This is the end of the Using a mobile banking app activity.

Next up, we'll find out how to get started with mobile banking in the Mobile banking for the first time activity.