How myGov helps with Centrelink and the ATO

How myGov helps with Centrelink and the ATO

What's coming up?

In this activity, you’ll learn a bit more about how myGov can help you with Centrelink payments - including the pension - and doing your tax via the Australian Taxation Office, or ATO.

Start activity

myGov and Centrelink

Among the many services that Centrelink handles, there is the Age Pension. With your myGov account, you can check the status of a pension claim, check or change your personal information, and manage your pension payments, all from the comfort of your own home.

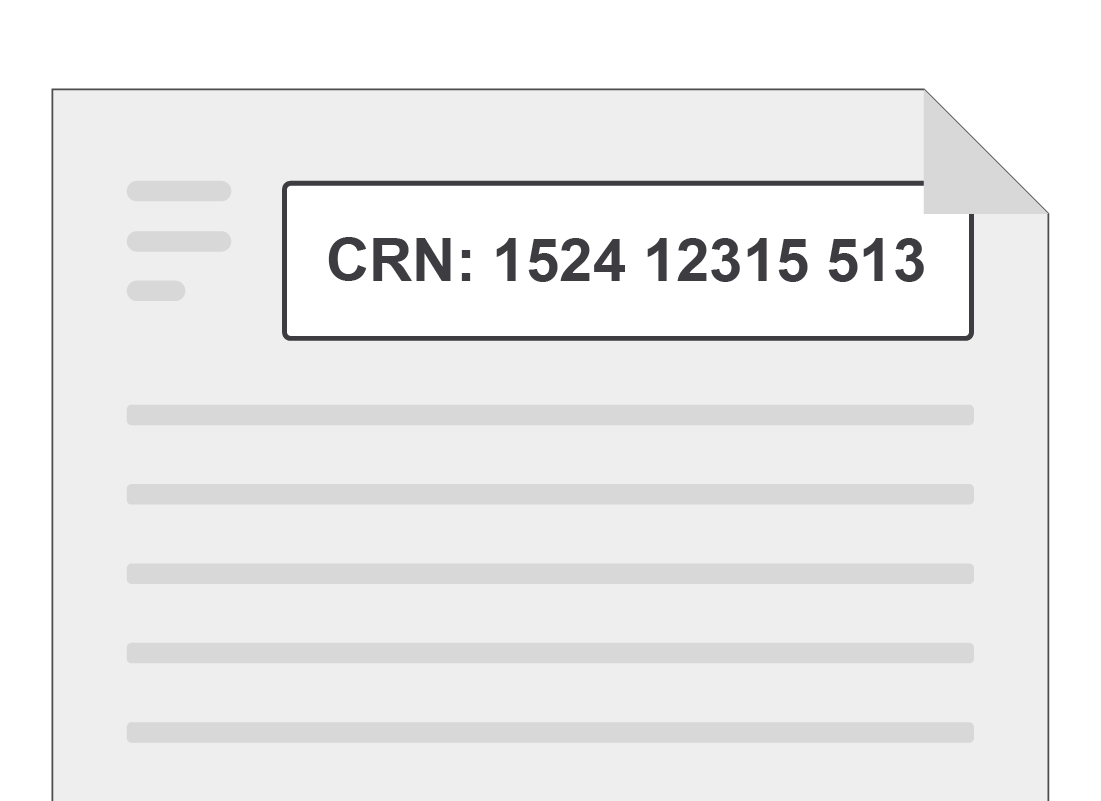

Using your Centrelink CRN with myGov

To use Centrelink with myGov, you need to have what’s called a Customer Reference Number, or CRN for short. If you already receive the Age Pension, you most probably have a CRN ready to go. To check, you can see if it's on a recent pension letter or notice you might have received. It's normally displayed somewhere easy to spot.

If you don't have a CRN yet, you may need to go in to a Centrelink office to get it set up first.

myGov and the Australian Taxation Office (ATO)

There are lots of important tax-related notices you might receive throughout the year. The myGov Inbox keeps all those notices together for you, and will also remind you if any payments are due, or if the ATO is waiting on information before they can refund you.

myGov at tax time

When tax time comes around, there can be an overwhelming amount of information to deal with and tasks to complete.

Once you have linked the ATO to your myGov account, lodging your tax return online will be easier to manage. The website can even handle some tasks automatically, such as prefilling financial information they already have from your bank or employer, or remembering to claim pensioner or veteran tax offsets and refunds for you.

Well done!

You’ve reached the end of the How myGov helps with Centrelink and the ATO activity. You should now know some more details about how myGov can make dealing with Centrelink and the Australian Taxation Office easier.

In the next activity, How myGov helps with My Health Record and Medicare, you’ll learn some extra details about the benefits of myGov can offer when dealing with those services.