Online banking FAQs

Online banking FAQs

What's coming up?

If you're new to online banking, it's normal to have lots of questions.

In this activity, we'll answer some of the most Frequently Asked Questions.

Start activity

How can I be sure it's safe?

Banks have your security as a priority. There are consumer laws about how they must protect you, and systems that help keep your funds safe.

Your bank also minimises risk by limiting the amount of money that can be taken from an account, and monitoring accounts for out-of-the-ordinary transactions.

Additional security steps

For some online banking activities, you will have to enter a special code that the bank sends to your phone. This is so the bank can double-check it's you using your online account.

This important additional layer of security is sometimes known as Two Factor Authentication, or Two Step Authentication.

What if I make a mistake?

Your bank maintains customer service telephone lines to help you if you have a problem. The number will be on your bank's website – just look for the Contact Us button.

Many banks also have a Chat feature, where you can type your question on the website and bank staff can type back with their response. That way, you can also keep a record of the conversation. Look for the Chat icon on the screen, or in the Contact Us section of your bank's website.

eSafety tip

When you're transferring money to someone else, always double-check the details as you go. Especially check their BSB (stands for Bank-State-Branch – a six-digit code that is unique to every branch of every bank in Australia) and the account number of the person you're transferring the money to. Be careful to enter the numbers without spaces.

If you enter the wrong numbers, you may not be able to get the money back.

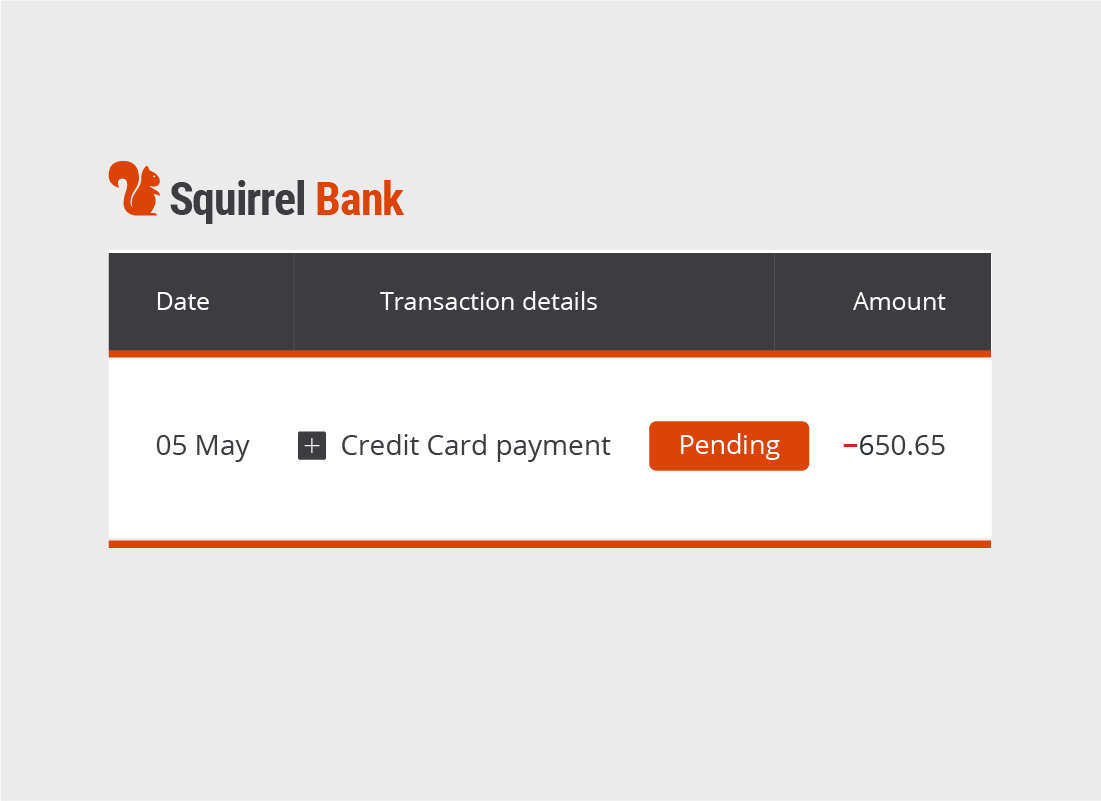

How do I know if a payment has gone through?

You don't have to wait for your monthly statement to see if your payments have been made. With online banking, you can see all your transactions within moments. Sometimes, it may take a few days to process the transaction. Those longer transactions will usually appear as Pending or something similar until they clear.

If you're ever worried about an important transaction, however, just call your bank's help line and ask them to check for you.

What if I think someone knows my password?

Of course, you should never share your online banking password and ATM PIN with anyone. However, if you suspect that someone knows them, you can get help to stop them from accessing your accounts any time, day or night.

Your bank has a contact telephone number for any security worries you have. A good tip is to write that number down somewhere you can find quickly, such as in an address book. Call up straight away to make sure no one can use the password or PIN. You can arrange for a new password or PIN while you're on the call.

How can I report a scam?

You may be contacted by someone pretending to be your bank, but who is actually trying to steal your money. One of the most common ways people try to do this is by email.

That kind of email can look a lot like it's from your bank. As with all suspicious emails though, it's important not to click on any links or open any documents it might contain.

If you think someone is trying to scam you, find the Report a Scam link on your bank's website. It will usually also have an email address that you can forward suspected scam emails to so that the bank can be aware of them too.

eSafety tip

Your bank will never ask for your PIN or password, so do not provide these if an email that looks like it's from your bank asks you to update your details.

Can I still get paper statements?

With online banking, you have a few options for how you'd like to receive your bank statements.

You can still have them posted to you if you prefer, but the bank may charge you for this service. Alternatively, you can download statements from your account on your bank's website whenever you need them. You can save these to your computer, or even print them out if you have a home printer and file them as paper copies.

Well done!

This is the end of the Online banking FAQs activity.

Next up, let's check some tips to be certain that your online accounts are the safest they can be in the Tips for safer online banking.