Ways to pay for goods online

Preparing to set up a new myGov account

What's coming up

In this activity, you'll learn about some of the options for making payments online, including direct transfers from your bank account, credit and debit card payments, and a very popular third-party payment system called PayPal.

Start activityDifferent ways to pay for goods online

You can't use cash to pay for goods and services from most online stores, but there are several reliable electronic methods you can use instead. These include:

- Direct deposit

- Credit or debit card

- Third-party payment systems, such as PayPal.

eSafety Tip

Some online stores, like Gumtree and Facebook Marketplace, help buyers and sellers meet in person to exchange cash for goods. It's best to avoid this, but if it is necessary, make sure you meet in daytime in a public place, and take a friend or relative with you.

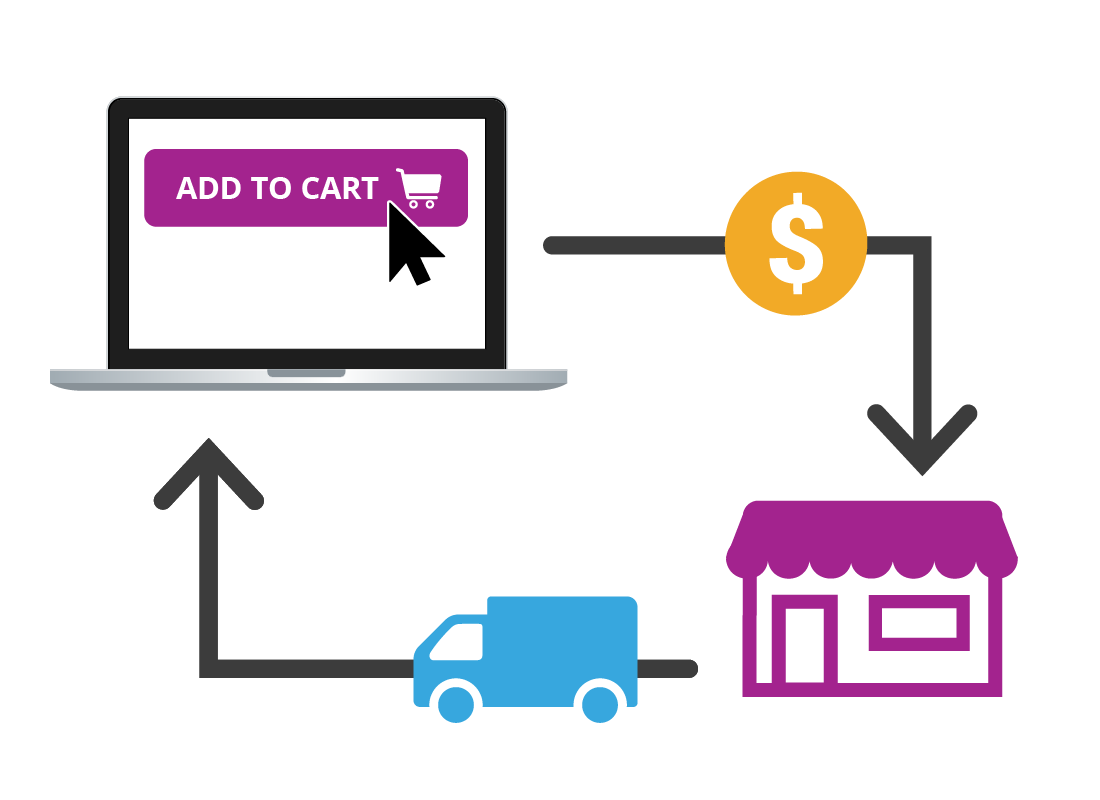

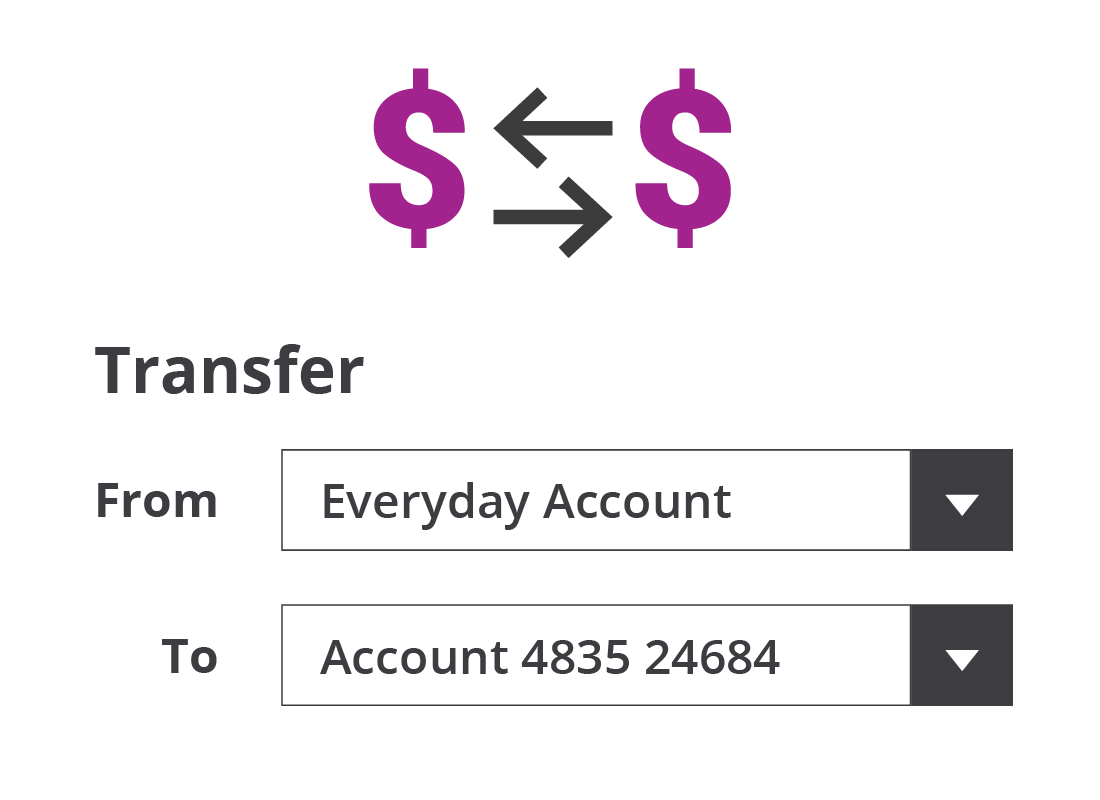

Paying by direct deposit

One of the easiest ways to pay for goods electronically is to make a direct deposit from your online bank account. This transfers funds from your bank account into the bank account of the store or person you're buying from.

Direct deposits can be risky, however. If you enter the seller's account details incorrectly, or if something goes wrong with the transaction, you have less chance of getting your money back than if you pay by credit card or PayPal.

Paying by credit or debit card

Credit and debit cards offer more protection than direct deposits. If you make a mistake entering your credit or debit card details, the payment will fail and you'll be notified immediately. If something goes wrong with the transaction, your bank may also be able to help get your money back.

eSafety Tip

Only enter your credit card, debit card or banking details into a trusted website that has a padlock and https:// in the address bar. These show that the website connection is encrypted, so that your data is protected when communicating with the website.

We also recommend you keep a record of your online purchases somewhere handy, and check your credit card and bank statements to make sure there are no additional charges or unexpected amounts being debited.

Third-party payment systems: Buy now, pay later

Many online shopping sites offer a service that allows you to use your credit card to pay for items in instalments, with no extra costs. It's like lay-by, except that you get your items straight away.

While these services can spread the cost of an item over time, there are expensive charges if you don't pay on time.

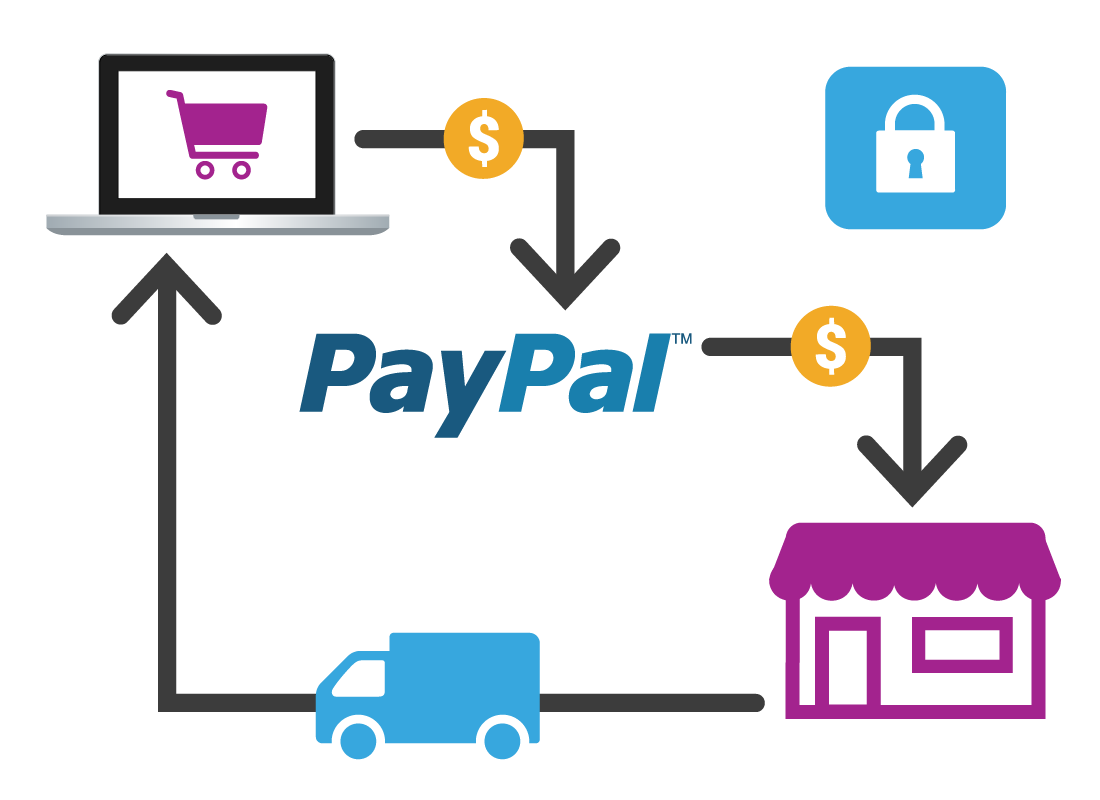

Third-party payment systems: PayPal

Paypal is a service that allows you to pay for online goods without sending your bank or credit/debit card details directly to the seller. It is a safer way to pay for goods as you don't have to share your personal banking details with multiple online stores, marketplaces or individuals. Instead, you pay PayPal, and PayPal then pays the seller.

How is using PayPal safer?

PayPal provides even greater protection for online purchases than credit cards.

When you pay with PayPal, the seller does not receive your payment until your item has been shipped. If you don't receive the item, it arrives broken or is not how it was described, PayPal will refund the cost of the item and the shipping cost.

This is very useful for sites like Gumtree or Facebook Marketplace, where private sellers can't always provide the guarantees you would get from a shop or reputable online retailer.

Is PayPal the only option?

Several services work in a similar way to PayPal, including Apple Pay, Google Pay and Samsung Pay.

While PayPal is used mostly used for online purchases, the other services are mostly used to buy physical items in the real world, using your smartphone, but can also be used to make purchases on eBay.

We will look in more detail at PayPal in the next activity.

Well done!

You've reached the end of the Ways to pay for goods online activity. You have learned about some of the options for paying online, and which way offers you the most protection.

Next up, we'll check out the advantages and disadvantages of PayPal in the Pros and Cons of PayPal activity.